Merchant Category Codes (MCCs): What they are and MCC code lookup

Oct 15, 2025

5 min

Key takeaways:

- Merchant Category Codes (MCCs) are 4-digit numbers used by card networks to classify businesses by industry type for transactions.

- MCCs affect interchange fees, credit card rewards, tax reporting, and payment restrictions.

- They are assigned by acquiring banks or payment processors based on a merchant's primary business activity.

- Misclassification can lead to higher fees or missed rewards; changing an MCC can be complex and requires approval.

- Common use cases include cashback categorization, expense tracking, and compliance with tax reporting standards.

- Businesses can look up MCCs through card network documents, payment gateway dashboards, or by contacting their acquirer.

- Billplz helps merchants track and understand MCCs with full transaction visibility — simplifying reconciliation, accounting, and decision-making.

Introduction

Every time a customer pays with a credit or debit card, the transaction is tagged with a four-digit number known as a Merchant Category Code (MCC). These codes classify businesses based on the goods or services they offer and play a significant role in how card payments are processed.

For businesses, the assigned MCC is a foundational element that determines the cost of accepting card payments. For card networks and financial institutions, MCCs are essential for risk management and tracking spending. For consumers, MCCs directly influence the rewards and benefits they earn.

In this guide, we'll explain what MCCs are, detailing their use cases and showing how businesses can look them up to better manage their payment operations.

What Are Merchant Category Codes (MCCs)?

An MCC is a four-digit number assigned by major card networks, such as Visa, Mastercard, and American Express. These codes are based on the ISO 18245 standard that functions as a universal tag for classifying a merchant's primary business activity.

Their purpose is to precisely identify the exact type of goods or services offered, which is then passed along with every card transaction.

For example, the code 5411 is used to designate Grocery Stores and Supermarkets, while 5812 is the specific MCC for Eating Places and Restaurants.

Also read: Paynet Malaysia: All you need to know about Malaysia's payment network

Why are MCCs important?

MCCs serve a crucial purpose by standardizing transaction data, which impacts compliance, risk, and profitability across the entire payment chain.

- For businesses

The MCC primarily affects interchange fees, which are the non-negotiable fees a merchant pays to accept a card. High-risk or specialized MCCs may have higher or lower fees, directly impacting a business’s processing costs and profit margins. It also helps determine tax reporting obligations. - For banks & payment processors

MCCs help acquirers and issuers track spending patterns, manage risk, and identify high-risk merchants who may be prone to higher fraud or chargeback rates. Issuers also use MCCs to set spending controls or restrictions on corporate and personal cards. - For consumers

The MCC is the trigger for rewards, cashback categories, and card benefits. If your card offers a bonus on "gas," the transaction must carry the corresponding gas station MCC to qualify. - For regulators

Bank Negara Malaysia (BNM) uses Merchant Category Codes (MCCs) to regulate payment systems under the Payment Card Framework (PCF). MCCs help categorize merchants to control domestic interchange fees, assigning lower rates to sectors like government services, taxes, petrol stations, and charities. This promotes electronic payments, supports economic monitoring, and helps manage financial risks within the payments ecosystem.

Common use cases of MCCs

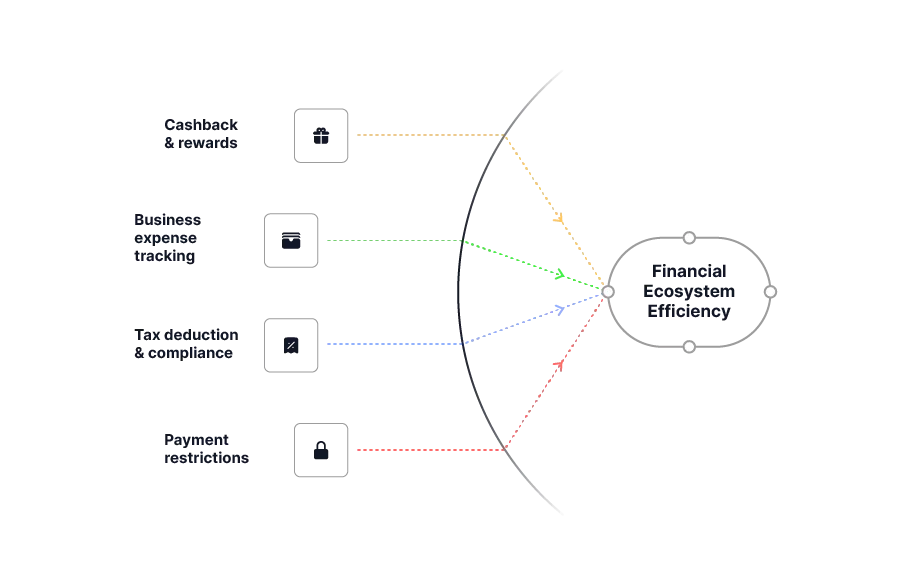

The standardized nature of Merchant Category Codes (MCCs) makes them invaluable across the financial ecosystem for categorizing merchant types.

Here are some of the most common uses:

- Cashback & rewards: MCCs determine whether a transaction qualifies for bonus points or cashback offers (e.g., ensuring a transaction carries the Restaurants MCC (5812) to get a dining reward).

- Business expense tracking: Companies use MCCs to automatically sort expenses in accounting software, which streamlines bookkeeping and financial reconciliation.

- Tax deduction & compliance: They help identify whether a payment is for services versus merchandise, assisting businesses in meeting specific tax reporting requirements (like filing a Form 1099).

- Payment restrictions: Card issuers implement spending controls using MCCs, allowing them to block high-risk transactions (e.g., gambling) or restrict a card's use to a specific category (e.g., travel expenses only).

How are MCCs assigned?

MCCs are not self-assigned by the merchant.

The code is assigned by the acquiring bank or payment processor (the institution that manages the merchant's account) when the merchant account is first opened.

This assignment is based on the merchant’s primary business activity as declared on their application. Once assigned, the unique 4-digit code is transmitted as part of the transaction data for every card payment accepted.

MCC codes and interchange fees

The relationship between your MCC and payment costs directly impacts your business's bottom line. The MCC is the key factor that determines the interchange fee—the transaction cost you pay to accept a card.

Card networks establish varying fee schedules based on the perceived risk of the business type. Merchants with MCCs associated with lower fraud or chargeback rates often qualify for lower interchange fees.

Conversely, high-risk or specialized MCCs incur higher rates. For instance, Charitable Organizations (MCC 8398) typically benefit from lower, preferential fees due to the low-risk nature of their transactions.

Merchant Category Code (MCC) lookup

Wondering what your business’s MCC is? Here's how you can find it:

- Card network documentation: Major networks, including Visa, Mastercard, and American Express, publish official, comprehensive lists or Merchant Data Standards Manuals that define every available MCC.

- Payment gateway dashboards: Check your online payment platform or gateway. Some platforms provide MCC visibility directly within their transaction reports or settings, making it easy to see the code assigned to your account.

- Contact your acquiring bank: Your acquiring bank or payment processor is the entity that assigned the code to your merchant account. They can confirm the exact MCC on file for your business.

For quick reference, here are a few common MCCs:

| MCC Code | Category | Example |

| 5411 | Grocery Stores | Supermarkets, Hypermarkets |

| 5812 | Eating Places & Restaurants | Cafés, Fast Food Chains |

| 5813 | Bars & Taverns | Nightclubs, Lounges |

| 5732 | Electronics Stores | Mobile Shops, Computer Stores |

| 5999 | Misc. & Specialty Retail | Pet Shops, Florists |

| 5013 | Retail Outlet Services | Auto Parts Wholesalers, Automotive Distributors, New Car Parts Suppliers |

| 5621 | Clothing Stores | Women's Boutiques, Ladies' Apparel Stores, Women's Clothing Chains |

For a full list of MCCs, always consult the documentation provided by the card networks, such as Citibank’s Merchant Category Codes for easy lookup and reference.

Challenges & considerations with MCCs

While MCCs are helpful, they’re not always perfect:

- Misclassification: Being assigned the wrong MCC can lead to higher fees or ineligibility for customer rewards. For example, a specialty caterer misclassified as a general retailer may miss out on dining perks.

- Changing MCC: Though you can request a change, it’s difficult. You must show that your business activity has significantly changed for the acquirer to approve it.

- Multiple services: Businesses with varied offerings (e.g., hotels with restaurants or spas) may be assigned just one MCC, which may not reflect all services—confusing rewards or reporting.

Billplz’s role in MCC transparency

Understanding how your transactions are categorized is key to managing fees, rewards, and financial reporting — and that’s where Billplz stands out.

Billplz brings clarity and control to your payment data by providing full visibility into Merchant Category Codes (MCCs). Each transaction is tagged and easily viewable, helping you understand how card networks classify your business.

With this transparency, businesses can:

- Easily reconcile payments by MCC, reducing errors in tracking income.

- Simplify accounting and tax reporting with clear categorisation of services.

- Make smarter decisions by understanding how MCCs affect fees and customer rewards.

With this clear access to payment categorization, even small businesses can avoid sifting through complex banking data.

FAQ

How to find my Merchant Category Code (MCC)?

The most reliable way is to contact your payment processor or acquiring bank. They can confirm the code they have on file for your merchant account. You can also sometimes find it in your online payment gateway dashboard or detailed transaction reports.

Can I change my MCC?

It is possible, but requires a formal request to your acquiring bank or payment processor. The change is typically granted only if your primary business activity has substantially changed and you now qualify for a different, official code.

Why does my MCC affect my card fees?

MCCs help determine your interchange rate. Lower-risk businesses usually get lower rates, while high-risk MCCs come with higher fees.

Do MCCs impact customer cashback and rewards?

Yes. Card issuers use the MCC to automatically identify the transaction type and determine if it qualifies for bonus rewards (e.g., 5x points on travel, 3% cash back on groceries). An incorrect MCC can cause your customers to miss out on rewards.

Who controls MCC codes?

MCCs are based on ISO standards and are implemented by card networks and acquiring banks.

Can I use someone else's MCC?

No. MCCs are tied to your business type and merchant account. Misusing MCCs is against card network rules and may result in penalties.

Conclusion

The Merchant Category Code (MCC) is far more than just a four-digit number—it is a critical piece of infrastructure that influences your processing costs, compliance requirements, and your customers' card benefits.

Understanding your MCC is vital for both financial health and reporting accuracy. As a merchant, you should check and confirm your assigned MCC with your provider to ensure it accurately reflects your business.