Payment link: What is it, how to create & use it for your business

Dec 2, 2025

6 min

Key takeaways:

- A payment link is a secure URL or QR code that lets customers pay without a website or POS system.

- It works well for Malaysian businesses collecting payments via WhatsApp, Instagram, email, or SMS.

- Top features to look for include local method support, branding options, security, and real-time reporting.

- Payment links help improve cash flow and reduce reliance on physical infrastructure or complex eCommerce setups.

- Most providers charge per transaction with no monthly fees — ideal for SMEs and seasonal sellers.

- Billplz supports both no-code and API-based payment links, with trusted local options like FPX, DuitNow QR, and e-wallets.

Introduction

For many Malaysian businesses, getting paid is as simple as sending a link. A payment link is a secure URL that allows customers to make a payment instantly, without needing a website, checkout, or POS system.

From social sellers to NGOs, more businesses are turning to payment links to accept FPX, DuitNow QR, and e-wallet payments through WhatsApp, Instagram, or email.

In this guide, we’ll walk through how payment links work, why they matter, and how Billplz helps businesses use them with ease.

What is a payment link, and how does it work?

A payment link is a unique URL or QR code that directs customers to a secure, hosted checkout page. Once opened, the customer can review the payment details and pay using their preferred method—typically FPX, DuitNow QR, or e-wallets in Malaysia.

The process is simple: the business creates a link with a specific amount and purpose, shares it via messaging apps or email, and the customer completes the payment. The transaction status is updated in real time and tracked through the provider’s dashboard.

Payment link vs payment gateway

A payment link is a fast, shareable way to get paid, often used by social sellers, freelancers, or businesses without a website. You simply generate a link and send it via WhatsApp, email, or Instagram. The customer clicks, pays, and you're done.

A payment gateway, on the other hand, is the full backend system that powers payments on websites and mobile apps. It requires technical integration and is typically used by larger businesses with custom checkouts or shopping carts.

Think of it this way:

- Payment link = No-code, fast, plug-and-play. Great for direct messaging and quick collections.

- Payment gateway = Developer-friendly, integrated into your platform or store. Better for high-volume or automated flows.

Whichever path you choose, make sure it supports local methods like FPX, DuitNow QR, and e-wallets, and offers transparent pricing with fast settlement.

For more information on payment getaways, read:

- Toyyibpay vs Billplz: Which payment gateway should you choose?

- Billplz vs Curlec: Which payment gateway should you choose?

- Billplz vs Stripe: Which payment gateway should you choose?

- Senangpay vs Billplz: Which payment gateway should you choose?

Key features and best practices to look for in payment link solutions

If you're a Malaysian business planning to collect payments online, here’s what to look for in a solution that’s both reliable and ready to scale:

- Local payment support: Accept payments via FPX, DuitNow QR, and e-wallets like GrabPay, Boost, and Touch ’n Go. All are essential for Malaysian customers.

Branding and customisation: Create branded checkout pages and personalised URLs to build trust and maintain consistency with your business identity. - Link management tools: Set expiry dates, control link access, and receive notifications when payments are completed, all from a central dashboard.

- Real-time reporting: Monitor transactions with clear summaries of customer details, payment status, and collection trends.

- Security and compliance: Ensure the solution is PCI DSS compliant and uses SSL encryption to keep customer data safe and secure.

- Developer-ready integration: For businesses with custom systems, API access allows dynamic payment link creation and seamless billing workflows.

Why do businesses in Malaysia need a payment link?

As more Malaysians shop, book services, and donate through their phones, businesses are moving toward mobile-first payment experiences. But not every business has a full eCommerce setup, and not every customer wants to check out through a complex site.

Payment links solve this gap. They let you collect payments through the platforms your customers already use. Whether you're sending an invoice or confirming an order, a secure link helps you get paid faster without the need for a website or POS system.

For many businesses, this also means better cash flow, easier tracking, and fewer manual steps. With real-time dashboards and automated notifications, payment links offer a simple yet powerful way to manage payments day to day.

What payment methods are supported by payment links in Malaysia?

Most payment link providers in Malaysia support FPX and DuitNow QR as standard. Many also offer additional options like e-wallets such as GrabPay, Boost, and Touch 'n Go, along with Buy Now Pay Later (BNPL) services.

Providing multiple local payment methods gives customers more flexibility to pay using what they already trust. This helps improve the payment experience and encourages faster completion.

How can Malaysian businesses create a payment link?

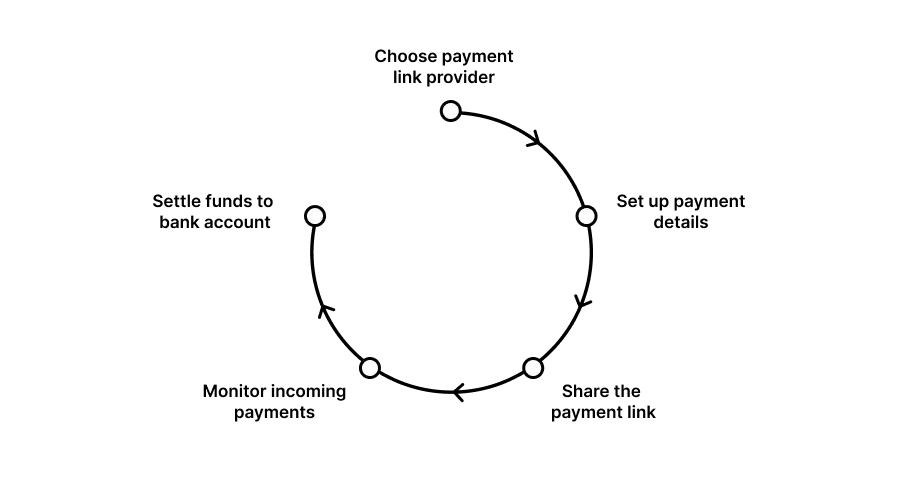

Getting started with payment links is simple. Here’s a step-by-step guide for local businesses:

Step 1: Choose a payment link provider

Select a provider that supports Malaysian payment methods like FPX and DuitNow QR. Look for transparent pricing, local settlement, and tools that match your business needs.

Step 2: Set up your payment details

Enter the payment amount, item or service description, and optionally set an expiry date for the link.

Step 3: Share the payment link

Send the link directly to customers through WhatsApp, Instagram, email, or SMS. No website or checkout page is required.

Step 4: Monitor incoming payments

Use the provider’s dashboard to track who has paid, how much, and when. Some systems offer real-time updates.

Step 5: Settle funds to your bank account

Once payments are received, funds are typically settled to your Malaysian bank account by the next business day.

This setup works well for SMEs, service providers, NGOs, and any business that values fast, secure collections without heavy infrastructure.

How to use payment links for your business?

From social sellers to service providers, payment links offer a simple way to collect payments, no website or app needed. Here’s how businesses in Malaysia are using them every day:

- Social sellers: Accept orders directly through Instagram DMs, WhatsApp chats, or Facebook messages without needing a website.

- Service providers: Tutors, freelancers, and consultants can send secure payment links to clients after delivering their services.

- Retailers and F&B outlets: Use payment links for online pre-orders, seasonal promotions, or limited-time offers, especially during peak sales periods.

- NGOs and community groups: Collect donations during fundraising drives, event registrations, or monthly contribution campaigns with simple links.

Payment link fees and cost considerations in Malaysia

Payment link providers typically charge a flat fee or a small percentage per transaction, often with no monthly charges, making them a good fit for small or seasonal businesses.

But price isn’t the only factor. It’s worth looking at how fast payments are settled, whether local options like FPX, DuitNow QR, or e-wallets are supported, and how transparent the fee structure is.

Billplz offers MYR-based pricing with no hidden charges, supporting a full range of local payment methods. It’s a practical way to manage costs while keeping the checkout experience simple and familiar for your customers.

How can Billplz help you accept payments with a link?

Billplz offers two flexible ways to create secure, trackable payment links, designed to suit businesses at any stage, from individual sellers to platforms with custom billing systems.

The payment form is the easiest way to start. You can create a branded payment page without any coding and share it through WhatsApp, Instagram, or email. Customers pay using familiar local methods like FPX, DuitNow QR, and major e-wallets. It's ideal for service providers, social sellers, NGOs, or any business that doesn't need a full website.

A direct payment gateway is built for developers and platforms that want more control. It lets you generate payment links dynamically via API and redirect customers directly to the payment screen, skipping the hosted form. This option works well for businesses with their own frontend or automated invoicing.

Both methods come with real-time tracking, local bank settlements, and compliance with Malaysian security standards.

FAQ

How to receive money through a payment link?

Choose a trusted provider, set up your payment details like amount and description, then generate the link. Share it via WhatsApp, email, or any channel you use. Once the customer pays, you'll see the update in your dashboard, and the funds will settle into your bank account shortly after.

How to know if a payment link is safe?

Check for HTTPS URLs, trusted providers, and official payment pages. Providers like Billplz comply with PCI DSS and use encryption.

Are payment links free?

Creating a payment link is usually free. Transaction fees apply when a payment is completed. These vary by provider and payment method.

Can I create my own payment gateway?

Building a custom payment gateway requires significant technical resources, ongoing maintenance, and regulatory approvals. For most businesses, it’s simpler and more cost-effective to use a reliable provider like Billplz, which already meets local compliance standards.

Is payment by link safe?

Yes, as long as a secure and verified platform issues the link. Look for encryption, PCI DSS compliance, and SSL protection. These are standard practices for most Malaysian payment providers.

Are payment links cheaper than traditional payment gateways?

For many small businesses and occasional sellers, payment links can be more affordable. They often come with lower upfront costs and no monthly fees, but it's still important to compare transaction rates and available features.

Can I send a payment link via WhatsApp or Instagram?

Absolutely. This is one of the most popular ways to use payment links in Malaysia, especially for social sellers and service providers. You can drop the link directly into chats, DMs, or captions for quick payments.

Conclusion

For many Malaysian businesses, collecting payments should be simple, secure, and accessible, even without a website or POS system. Payment links offer exactly that.

Whether you’re a social seller, NGO, freelancer, or service provider, payment links give you the flexibility to receive payments through channels your customers already use, from WhatsApp to email.

Billplz supports this with local-first solutions, along with real-time tracking, MYR settlement, and secure infrastructure. It's a practical way to streamline how you collect payments while meeting the expectations of local buyers.

Explore the Billplz payment form to simplify your collection process and offer trusted, local payment experiences.