Billplz vs Curlec: Which payment gateway should you choose?

Nov 6, 2025

6 min

Key takeaways:

- Billplz is better suited for SMEs looking for cost-effective, local-first payment solutions with simple setup and faster payout (T+1 FPX or real-time via DuitNow).

- Curlec offers stronger tools for recurring billing and is ideal for SaaS, NGOs, and education platforms managing complex subscriptions and direct debits.

- Billplz offers flat, transparent pricing starting from RM0.70 per transaction, making it easier for local businesses to forecast costs.

- Curlec charges percentage-based fees and has an onboarding cost, which may suit businesses with larger average transaction values.

- Billplz supports Malaysia’s key payment methods (FPX, DuitNow, e-wallets, BNPL) and integrates easily with Shopify, WooCommerce, and more.

- For most local-first Malaysian businesses, Billplz delivers a simpler, faster, and more scalable solution without the overhead.

Introduction

Payment gateways are essential for Malaysian businesses, especially SMEs, eCommerce brands, and businesses with subscription models. They directly affect how fast you get paid, what fees you incur, and how simple it is to scale operations.

In this guide, we compare two strong local solutions: Billplz and Curlec. While Billplz is known for its low-cost, fast-settlement approach, Curlec (now part of Razorpay) offers a more tech-forward platform focused on recurring payments.

Let’s break down their key differences to help you decide.

Overview of both platforms

What is Billplz?

Billplz is built for Malaysian SMEs, startups, and NGOs that need affordable, efficient ways to collect payments. It focuses on FPX (online banking), real-time transfers, and bulk payouts, making it ideal for local-first businesses.

What is Curlec?

Curlec, now part of Razorpay, is a Malaysian payment gateway with strong support for recurring billing. It’s built for eCommerce businesses and subscription-first models that need automation, a polished checkout experience, and support for direct debit.

While powerful, Curlec may require more technical setup.

What are the key differences between Billplz and Curlec?

| Feature | Billplz | Curlec |

| Target Users | Malaysian startups, SMEs, NGOs, and growing teams looking for simple, affordable payments. | Businesses with advanced billing needs, recurring revenue, or custom-branded checkout flows. |

| Transaction Fees | Flat, transparent fees from RM0.70 per FPX transaction, depending on plan. | Percentage-based fees for FPX and e-wallets; varies by method and use case. |

| Setup / Onboarding | Quick and easy onboarding with a free Basic plan. No upfront fees required. | A setup fee applies, with more steps for access to subscription tools. |

| Payment Methods | Supports FPX (core), e-wallets, cards, BNPL | Offers FPX, cards, direct debit, BNPL, and recurring bank debits. |

| Recurring Billing | Supported via API and plugins. Great for simple subscriptions. | Built-in subscription engine with flexible models, automated retries, and lifecycle tools. |

| Integrations & Tools | Developer-friendly API, plugins, multi-user dashboards, webhooks, and payment links. | Strong dev tools, dashboard, and compliance modules. |

| Local Fit & Support | Malaysian-first focus with local support and cash flow–friendly payout cycles. | Operates in Malaysia with Razorpay’s global tech stack behind it. |

Billplz vs Curlec: Fee comparison

Billplz offers cost-efficiency with flat-rate FPX fees starting from RM0.70, especially suited for smaller transactions. Its Free plan allows many businesses to get started without setup fees.

Curlec has a broader fee structure to cover direct debit, recurring billing, and other services. While transparent, its percentage-based fees and RM500 setup cost may be more suited to businesses with larger ARPU or recurring models.

Read more on Billplz pricing here!

Payment features & local fit

Billplz covers Malaysia's most-used payment options: FPX, DuitNow, major e-wallets, BNPL, and card payments. It’s optimised for real-time FPX and local integration with a simple next-day settlement.

Curlec supports FPX, debit and credit cards, e-wallets, and BNPL. Some of its products also include Shariah-compliant features. Its direct debit and recurring tools are key strengths.

Subscription & recurring billing

Billplz supports recurring collections through its API and plugins, making it a solid fit for SMEs with straightforward subscription models. It integrates with platforms like WooCommerce, EasyStore, and others, giving businesses flexibility in how they manage recurring payments.

Curlec is subscription-focused, offering advanced billing models (fixed, usage-based), automated retries, and end-to-end subscription lifecycle tools. Ideal for gyms, SaaS, and education platforms.

Integrations & support

Billplz integrates smoothly with platforms like WooCommerce, Shopify, and more. It also supports invoicing, split payments, team dashboards, and pre-built plugins for over 30 local platforms.

Developers can tap into REST APIs and real-time webhook notifications to streamline operations and stay in sync.

Curlec provides API-first access, dashboards for monitoring real-time payment activity, and pre-built features for Islamic-compliant collections.

Read more about Billplz integrations here!

Security, compliance & reliability

Billplz is built for Malaysian businesses from the ground up. It complies with local banking regulations and is PCI DSS certified, so your transactions stay protected with bank-level security. Its infrastructure is designed to be reliable, secure, and well-suited for the daily demands of SMEs and online sellers.

Curlec benefits from Razorpay’s global infrastructure, offering strong uptime, robust encryption, and compliance with international standards.

While both platforms are secure, Billplz’s local-first compliance and alignment with Malaysian systems give it a practical edge for businesses focused on operating within Malaysia.

Settlement & payout

Billplz provides next-business-day (T+1) settlements for FPX, helping businesses maintain steady cash flow and better financial visibility. Enterprise users can also access real-time payouts through DuitNow Transfer, making it easier to manage disbursements or supplier payments without delays.

Its predictable schedule gives SMEs more control over daily operations and expenses.

Curlec typically settles payments within T+2 business days. While the process takes slightly longer, it’s designed for automation, especially for recurring payments and direct debit models.

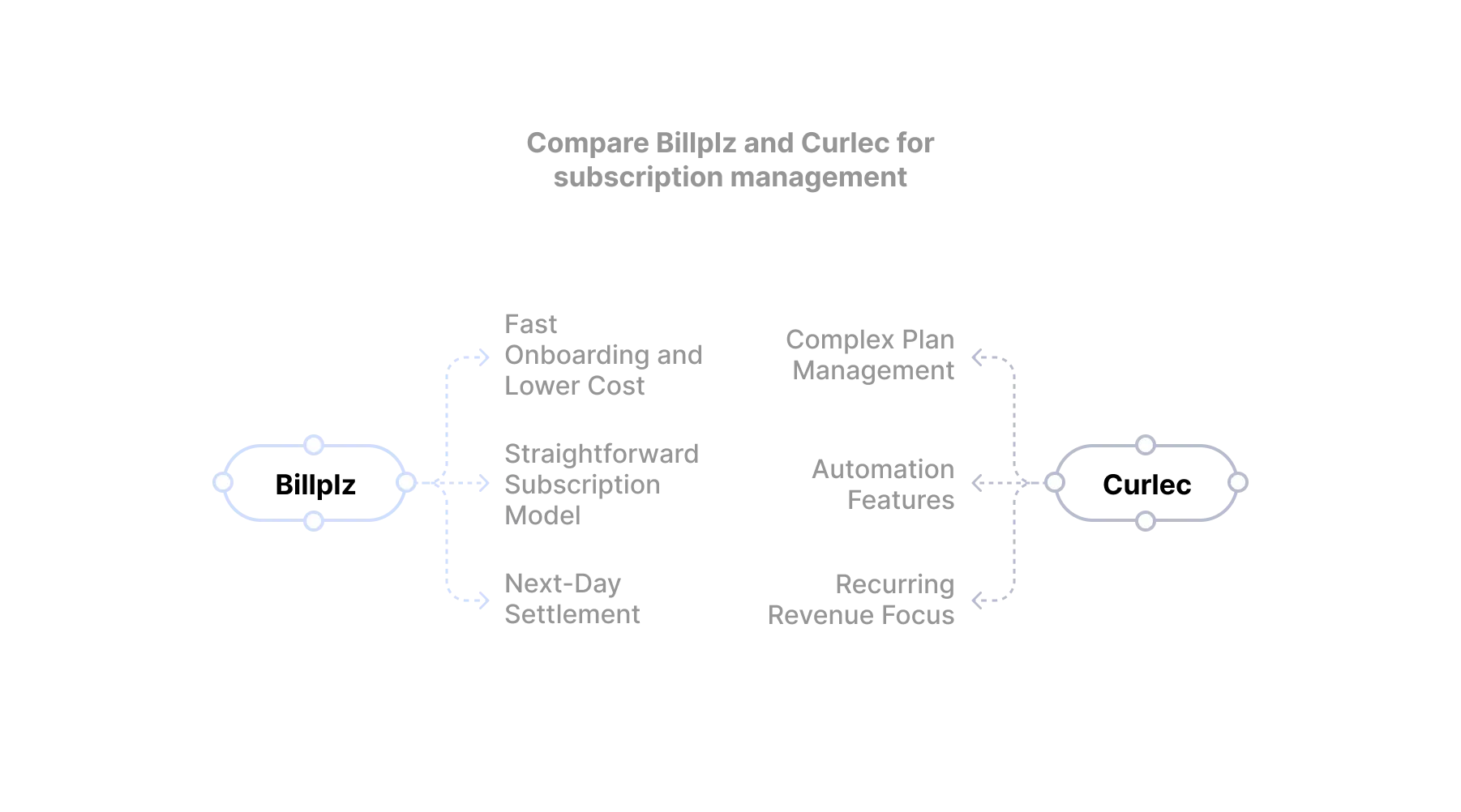

Billplz vs Curlec: Which suits subscriptions better for Malaysian businesses?

If your business is built on recurring revenue, choosing the right payment gateway for subscriptions can make all the difference.

Choose Billplz if:

- You want fast onboarding with minimal setup and lower upfront cost.

- Your subscription model is straightforward and works well with tools like WooCommerce and API integrations.

- You rely on next-day settlement to maintain a healthy cash flow.

- You need an easily scalable payment system that grows with your business, without complicated processes or additional fees.

Choose Curlec if:

- You manage more complex subscription plans, such as direct debit or tiered recurring billing.

- You need automation features like smart retry logic and billing cycle control.

- You're running a SaaS, NGO, or education platform where recurring revenue is central.

Billplz is a strong fit for most Malaysian SMEs with simple recurring needs and local-first growth goals. If your business is built around subscriptions and needs a more advanced billing engine, Curlec brings more control, but often with more setup and cost.

How does Billplz help Malaysian businesses scale?

Billplz is built to grow with you, from your first few customers to full-scale operations. Its local-first approach, combined with developer tools and transparent pricing, gives Malaysian businesses the flexibility to scale without getting overwhelmed.

- Transparent, predictable pricing: No setup or monthly fees on the Basic plan, just straightforward transaction rates that scale with your business.

- Fast setup and payouts: Get started quickly and receive FPX payments as early as the next business day, helping you keep cash flow healthy. Also read: FPX payment for business: How it works, guides & our solutions.

- Local payment methods that convert: Accept FPX, cards, and major e-wallets like TNG, Boost, and GrabPay — all optimised for Malaysian customers.

- Built-in scalability tools: Integrate easily using ready-made plugins for Shopify, WooCommerce, and EasyStore, or tap into Billplz’s robust API and webhooks.

- Real-time sync with webhooks: Keep your systems updated with instant notifications. This is perfect for growing teams and automated workflows.

Billplz gives you everything you need to scale with control, clarity, and confidence, without the complexity.

Also read: BNPL Malaysia & Billplz: Our integrations, comparisons & offerings.

FAQ

Which payment gateway is better for recurring billing?

Curlec is built around subscriptions. Billplz supports recurring billing via API and plugins, ideal for simpler models.

Are Billplz and Curlec suitable for small businesses?

Yes. Billplz is especially SME-friendly with low entry costs and fast setup. Curlec suits businesses with more complex billing needs.

How do they compare in fees?

Billplz offers flat, transparent pricing from as low as RM0.70 per FPX transaction. Curlec uses a percentage-based model, which may vary by use case.

Does Curlec support Islamic finance?

Yes. Curlec includes Shariah-compliant features tailored for NGOs and ethical finance use cases.

Which one has faster payouts?

Billplz offers next-business-day (T+1) FPX settlements and real-time payouts via DuitNow. Curlec typically settles in T+2.

Can they integrate with eCommerce?

Yes. Both Billplz and Curlec support Shopify, WooCommerce, and custom integrations via API.

Also read: Shopify vs WooCommerce (WordPress): An updated, comprehensive comparison.

Is Curlec better for subscriptions?

It’s stronger for advanced subscription models. Billplz works well for SMEs with simpler recurring setups and faster payouts.

Conclusion

Both Billplz and Curlec are trusted Malaysian payment solutions. Your decision depends on your needs.

Billplz is the go-to for SMEs looking for cost-efficiency, local focus, and fast payouts. Curlec, on the other hand, is best for businesses managing subscriptions, complex billing, and needing automation.

If fast setup, local support, and clear pricing sound like your kind of fit, Billplz is ready to support your next stage of growth.

Start with Billplz to give your business a trusted, scalable payment backbone designed for the future. New merchants receive MYR 25.00 in starter credit with code GROWTHPRO (valid until 31 December 2025).

For more information about Billplz, read: