BNPL Malaysia & Billplz: Our integrations, comparisons & offerings

Oct 15, 2025

8 min

Key takeaways:

- BNPL (Buy Now, Pay Later) is a fast-growing payment method in Malaysia, with over RM7.1 billion spent in H2 2024 by more than 5 million users.

- It allows customers to split payments into instalments, often interest-free, making it ideal for both essential and discretionary purchases.

- Major BNPL players in Malaysia include Atome, Grab PayLater, Shopee SPayLater, Boost PayFlex, and others—each offering unique features and plans.

- BNPL helps businesses boost sales, increase Average Order Value (AOV), reduce cart abandonment, and reach credit-averse customers.

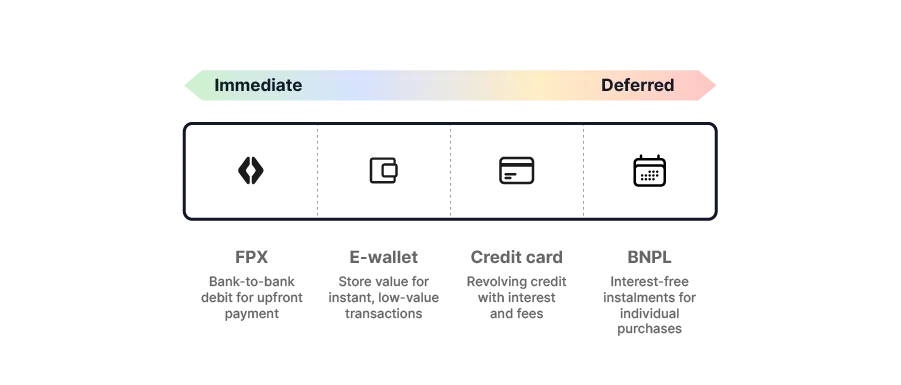

- Compared to traditional methods like FPX, credit cards, and e-wallets, BNPL offers unmatched flexibility for consumers.

- Billplz integrates with top BNPL providers, enabling businesses to offer BNPL at checkout with a centralised dashboard, real-time tracking, and simplified payout management.

- Billplz’s platform is scalable, secure, easy to integrate, and trusted by businesses across retail, healthcare, education, and travel industries.

Introduction

Buy Now, Pay Later (BNPL) has quickly become a popular way to pay in Malaysia. What started as a niche option is now widely used, especially by those who prefer flexible payment plans over traditional credit cards.

In the second half of 2024 alone, more than 5.1 million Malaysians used BNPL services, spending over RM7.1 billion (Source: 5.1 Million Malaysians Now Use BNPL, Most Earning Below RM5,000).

It’s no longer just for luxury items. Many people now rely on BNPL for everyday needs and unexpected expenses.

In this guide, we’ll explain how BNPL works in Malaysia, compare the top providers, and show how Billplz helps businesses easily integrate BNPL into their checkout process for a smoother, smarter experience.

What is Buy Now, Pay Later (BNPL)?

BNPL is a short-term financing option that allows consumers to make a purchase immediately and defer the payment, typically splitting the cost into a series of smaller, manageable instalments over a short period (usually 3 to 6 months).

Some plans are interest-free, while others may include small service fees depending on the duration and provider.

How BNPL works?

BNPL simplifies the purchasing process by breaking payments into instalments while ensuring merchants get paid upfront. Here's how it works:

- Customer selects BNPL at checkout: The shopper chooses a BNPL provider (e.g., Atome or Grab PayLater) as their payment option.

- Customer pays in instalments: The customer pays the BNPL provider in staggered, scheduled payments, often interest-free if they meet all deadlines.

- Merchant receives upfront payment: The business receives the full transaction amount immediately from the BNPL provider, minus a transaction fee. The merchant assumes zero credit risk associated with the customer's repayments.

Businesses, both online and physical, are quickly adopting BNPL for powerful commercial advantages:

- Boost sales conversion: Offering flexible payment options significantly reduces purchase hesitation, making customers more likely to complete a transaction.

- Increase AOV (Average Order Value): When the total price is broken into smaller chunks (e.g., RM400 becomes 4 monthly payments of RM100), shoppers feel more comfortable buying more, leading to higher basket sizes.

- Reduce cart abandonment: The ability to instantly defer payment overcomes cost barriers at the final checkout stage.

BNPL in Malaysia – Current landscape

BNPL is now a mainstream financial tool in Malaysia, especially among Gen Z and millennials seeking flexibility over credit cards.

- Adoption and growth

With millions of active users, Malaysia is one of Southeast Asia's fastest-growing BNPL markets. The sheer volume of transactions (RM7.1 billion in H2 2024) demonstrates its market penetration. - Rising consumer demand

Demand is high, not just for discretionary spending but also for essentials like groceries, medical bills, and school supplies. BNPL acts as a crucial financial tool for consumers managing liquidity between paychecks.

Surveys show that BNPL has enabled 63% of users to shift away from riskier informal lenders (Source: Top 3 BNPLs in Malaysia and What’s Next for the Market in 2025). - Regulatory environment

The proliferation of BNPL services has attracted the attention of regulators. Bank Negara Malaysia (BNM) is actively monitoring the digital credit landscape.

Crucially, the Consumer Credit Act (tabled in 2025) will require all Buy Now, Pay Later (BNPL) providers to be licensed and regulated by the new Consumer Credit Commission. This ensures stronger consumer protection and oversight.

Popular BNPL providers in Malaysia

- Atome offers 3, 6, or 12-month instalment plans, with some carrying a 1.5% monthly fee. Many merchants offer interest-free options. It’s widely used in fashion, beauty, lifestyle, fitness, and travel, and includes the Atome+ rewards programme for cashback and promotions.

- Grab PayLater allows users to split purchases into 4, 8, or 12-month instalments, or consolidate into a single monthly bill. It’s integrated across the Grab ecosystem (rides, food, shopping) and offers up to 1.5x GrabRewards points on eligible payments.

- Shopee SPayLater provides flexible plans from 1 to 24 months, is fully integrated with Shopee and ShopeePay, and is Shariah-compliant. Users can pay via cards, ShopeePay, online banking, or cash.

- Boost PayFlex is a Shariah-compliant BNPL solution that stands out for its extensive reach, allowing users to make payments in up to 24-month instalments at over 1.8 million DuitNow QR merchants nationwide, as well as for utility bills and e-wallet top-ups.

- Other providers like PAYLATER Malaysia and Moby also offer flexible BNPL options across local and regional retailers.

Here’s a quick side-by-side comparison of Malaysia’s top BNPL providers, their features, and where they shine.

| Provider | Instalment options | Interest | Key features | Popular use case |

| Atome | 3, 6, or 12 months | Some plans with 1.5% fee; many are interest-free | Atome+ rewards; strong presence in fashion, beauty, lifestyle, travel | Retail, fashion, lifestyle |

| Grab PayLater | 4, 8, or 12 months; or a monthly bill | Interest-free | Integrated into Grab (rides, food, shopping); up to 1.5x GrabRewards | Transport, food delivery, and eCommerce |

| Shopee SPayLater | 1 to 24 months | Interest may apply (varies) | Shariah-compliant; linked to Shopee & ShopeePay; multiple payment methods | Online shopping via Shopee |

| Boost PayFlex | Up to 24 months | Not specified | Shariah-compliant; accepted at 1.8M+ DuitNow QR merchants; supports bills & top-ups | Bill payments, offline shopping, e-wallet top-ups |

Benefits of BNPL for businesses

Implementing BNPL offers merchants tangible, immediate advantages that go beyond just flexible payments:

- Increased sales conversion: By removing the immediate financial hurdle, customers are more likely to finalize their purchase.

- Higher basket size: Splitting payments encourages shoppers to add more items to their cart, significantly boosting the Average Order Value (AOV).

- Customer loyalty: Providing flexible and accommodating payment options enhances the customer experience, fostering trust and encouraging repeat buying.

- Instant payout: The business receives the full transaction amount upfront, ensuring healthy cash flow without exposure to instalment or default risk.

- Access to new customer segments: BNPL appeals to younger, credit-averse consumers who may not use credit cards, helping merchants tap into previously underserved demographics.

- Reduced cart abandonment: Offering BNPL at checkout can reduce friction in the buying process, lowering abandonment rates, especially for high-ticket items.

- Marketing & discovery opportunities: Being listed on BNPL providers’ platforms (e.g., Atome or Grab PayLater) gives merchants exposure to millions of active users.

BNPL vs traditional payment methods

How does BNPL stack up against common payment methods like credit cards, FPX, and e-wallets?

Here’s a quick comparison to help businesses and consumers understand the differences.

BNPL vs Credit cards

BNPL offers short-term, interest-free instalments (e.g., 4 payments over 6 weeks) tied to individual purchases. It's easy to access, requiring only a soft credit check and appeals to those who prefer flexible, low-risk budgeting tools.

Credit cards, by contrast, are revolving credit lines that allow ongoing borrowing but often come with high interest rates, annual fees, and stricter approval (usually based on credit score). They’re valued for universal acceptance, rewards, and credit-building potential.

BNPL is ideal for simplicity and short-term purchases, while credit cards offer more flexibility for ongoing spending and consumer protections.

BNPL vs FPX

FPX (Financial Process Exchange) is an immediate bank-to-bank debit, making it a definitive, upfront payment method. BNPL, conversely, is a deferred/split payment, introducing crucial flexibility that FPX cannot offer.

While FPX is excellent for immediate settlement and often has lower merchant fees, it does not help customers manage large-ticket purchases.

For more information on FPX, read: FPX payment for business: How it works, guides, & our solutions

BNPL vs E-wallets

E-wallets like Touch ‘n Go eWallet and ShopeePay are primarily used for daily, low-value transactions, acting as a convenient way to store value or transfer funds instantly. BNPL extends actual credit for higher-value, non-essential purchases, targeting a different consumer spending behavior.

The key takeaway is that BNPL complements, not replaces, traditional methods. It is a specialized tool used to unlock high-value purchases that a customer might otherwise abandon.

Billplz BNPL integrations

Billplz serves as the unified platform that simplifies digital payment acceptance for Malaysian businesses. By integrating with leading BNPL providers like Atome and Grab PayLater, Billplz ensures that you can offer these high-demand payment options without managing multiple separate vendor accounts.

Through Billplz integrations, businesses gain powerful features:

- Centralised dashboard: Manage and reconcile all payment channels like BNPL, FPX, DuitNow, and cards from a single, unified dashboard.

- Seamless checkout experience: Customers enjoy a clean, frictionless checkout, automatically routed to their chosen BNPL provider upon selection.

- Real-time tracking of BNPL transactions: Monitor BNPL transaction status instantly alongside all other payment methods.

- Payout management simplified: Billplz handles the complex settlement process with the BNPL provider, ensuring funds are transferred to your bank account quickly and clearly.

Why choose Billplz for BNPL payments?

As a leading Malaysian payment gateway, Billplz is uniquely positioned to help local businesses adopt BNPL seamlessly by integrating it directly into its existing robust payment infrastructure.

- One platform, multiple methods: Billplz offers a full-stack solution supporting all major payment methods in Malaysia, including FPX, DuitNow, cards, and now, essential BNPL options.

- Transparent pricing: Benefit from Billplz’s transparent pricing model, featuring flat fees and clear settlement terms, allowing for easy cost management.

- Easy integration: Utilize existing Billplz APIs and plugins for popular platforms (Shopify, WooCommerce, etc.) to integrate BNPL with minimal technical effort.

- Scalable for SMEs to enterprise: The platform is built to support businesses of all sizes, from small online sellers to large corporate merchants.

- Trusted infrastructure: Rely on a proven platform with high reliability, featuring 99.999% uptime and backed by PayNet-endorsed infrastructure.

Also read: PayNet Malysia: All you need to know about Malaysia's payment network

FAQ

Why has BNPL become popular among consumers?

BNPL offers instant gratification, zero-interest instalments, and budget-friendly flexibility, especially appealing for younger consumers and households managing cash flow between paychecks.

Is BNPL safe for businesses?

Yes, BNPL is very safe for businesses. When a customer selects BNPL, the provider assumes the credit risk. The merchant receives the full purchase amount upfront (minus the merchant fee) from the BNPL provider, regardless of whether the customer completes their instalments.

How much does BNPL cost merchants compared to FPX?

BNPL typically comes with higher fees than FPX, due to the credit risk and infrastructure involved. However, these are offset by increased sales and order values.

What are some challenges & considerations in BNPL?

Some challenges and considerations include:

- Consumer Overspending Concerns: BNPL's accessibility raises regulatory concerns about customers falling into debt cycles if not used responsibly.

- Merchant Fees: The processing fees are generally higher than traditional payment options like FPX.

- Regulatory Developments in Malaysia: Businesses must be prepared for the upcoming Consumer Credit Act, which will formalize regulation and oversight.

- Choosing the Right BNPL Partner: Selecting partners whose user base aligns with your product category is crucial.

How does BNPL benefit eCommerce businesses in Malaysia?

It leads to higher conversion rates for expensive items, enables significantly larger Average Order Value (AOV), and is highly effective in reducing cart abandonment by lowering the initial financial commitment.

Can retail stores in Malaysia use BNPL with Billplz?

Yes! Through Billplz integrations, retail stores (online or in-person) can easily offer BNPL via supported terminals or platforms.

What industries in Malaysia benefit most from BNPL adoption?

- E-commerce & retail: The biggest beneficiaries, seeing higher conversion and bigger basket sizes for general goods, electronics, and fashion.

- Education & training: Allows students or parents to pay tuition or course fees in manageable monthly instalments.

- Healthcare & aesthetics: Makes treatments, dental procedures, or aesthetic packages more accessible by splitting large, often unexpected, costs.

- Travel & lifestyle: Enables customers to book flights, packages, or large purchases like electronics and pay for them over time.

Conclusion

The evolution of consumer credit in Malaysia shows that BNPL is no longer an optional payment add-on; it is a key driver for both online and offline sales growth. With this flexibility, businesses can capture a massive segment of the market that demands convenient, short-term credit solutions.

Billplz simplifies this integration, offering businesses one unified platform to manage all their payment methods efficiently.

Choosing Billplz means delivering modern, flexible payment options to your customers—while ensuring transparency, streamlined reconciliation, and operational efficiency for your business.

Expand your payment options with Billplz’s BNPL integrations today. New merchants receive MYR 25.00 in starter credit with code GROWTHPRO (valid until 31 December 2025).