FPX payment for business: How it works, guides & our solutions

Oct 15, 2025

6 min

Key takeaways:

- FPX (Financial Process Exchange) is a secure, real-time online payment method backed by Bank Negara Malaysia, enabling customers to pay via internet banking.

- It is widely used in e-commerce, education, donations, government payments, and bill settlements, offering lower fees and faster processing than cards or wallets.

- For businesses, FPX means instant payments, reduced fraud, no chargebacks, and a broad customer reach through all major Malaysian banks.

- Billplz offers flat fees from RM 0.70 per FPX transaction, next business day settlement, and easy integration via dashboard or API.

- Trusted by brands like Pandora, Farm Fresh, Boost, and Perodua, Billplz is ideal for businesses of all sizes looking for a reliable FPX solution.

Introduction

In today’s digital-first economy, businesses in Malaysia need reliable, secure, and efficient payment systems. Financial Process Exchange (FPX) is one of Malaysia’s most trusted and widely used online payment methods.

Designed for seamless real-time fund transfers via internet banking, FPX enables customers to pay directly from their bank accounts, eliminating the need for credit or debit cards.

For businesses, this means secure transactions, faster settlements, and lower processing fees — making FPX a valuable addition to any payment ecosystem.

Trusted by millions of Malaysians and backed by Bank Negara Malaysia, FPX has become a preferred option for businesses.

This guide explores how FPX works, its benefits, and how Billplz helps you integrate FPX easily into your business operations.

What Is FPX payment?

FPX (Financial Process Exchange) is a Malaysian-based online payment system operated by PayNet, a subsidiary of Bank Negara Malaysia. It enables consumers to make payments online directly from their Savings, Current, or Credit Card accounts (depending on merchant availability) through their bank’s internet banking portal.

When customers use FPX, they’re redirected to their online banking environment to complete the transaction, ensuring secure authentication and real-time fund transfers.

What is FPX used for?

FPX is used for various purposes, including:

- E-commerce: Paying for goods and services on online stores.

- Bill payments: Settling utility bills, loan repayments, and other recurring charges.

- Government services: Paying for government-related services, fines, and taxes.

- Education: Paying school fees and university tuition.

- Donations: Making online donations to NGOs and charities.

How does FPX payment work for businesses?

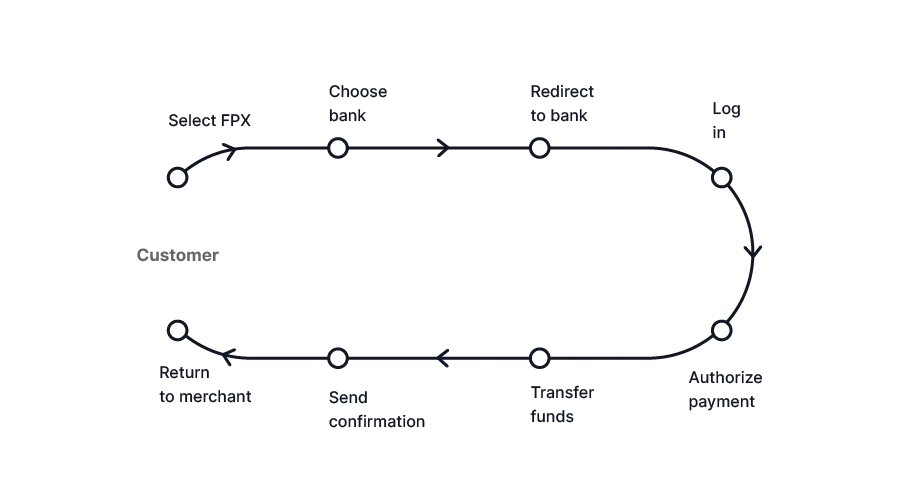

When a customer chooses to pay via FPX on a business's website, they are redirected to a secure payment page. On this page, they select their bank and are then taken to their bank’s internet banking login page.

After logging in, the customer authorizes the payment. Once the payment is confirmed, the FPX network instantly notifies both the customer and the business of the successful transaction.

The funds are transferred directly from the customer’s bank account to the business's bank account, with the entire process happening in real-time. This eliminates the delays associated with other payment methods and provides immediate confirmation of the sale.

This streamlined process ensures that businesses can process orders and services immediately, improving operational efficiency. The real-time nature of the transaction also helps reduce the risk of non-payment and allows for quick reconciliation of accounts.

Benefits of using FPX for businesses

- Real-time transactions: Payments are processed instantly, allowing for immediate order fulfilment and service delivery.

- Lower transaction fees: FPX generally has lower transaction fees compared to credit or debit card processing fees.

- Enhanced security: Transactions are conducted within the secure environment of the customer’s bank portal, reducing the risk of fraud and data breaches. Two-factor authentication (2FA) is used to verify the customer's identity.

- High trust & adoption: FPX is a trusted payment method in Malaysia, which increases customer confidence and conversion rates.

- No chargebacks: Since payments are directly debited from the customer's bank account and authenticated by the bank, there is no risk of chargebacks, which is a common issue with credit cards.

- Broad customer reach: FPX supports all major banks in Malaysia, allowing businesses to accept payments from a wide range of customers.

- Easy integration: FPX works seamlessly with leading platforms and payment gateways, making it simple for businesses to add it as a payment option.

FPX vs other payment methods

- FPX vs Credit/Debit cards: FPX offers lower fees, a quicker next-day settlement, and enhanced security as transactions are directly authenticated by the customer's bank, eliminating the risk of card fraud and chargebacks.

- FPX vs E-wallets: FPX serves a broader demographic through internet banking with higher limits, while e-wallets are popular for smaller, mobile-friendly transactions but often capped by wallet limits.

In summary, use FPX for high-value transactions or for customers who prefer the security and convenience of direct bank transfers. Use credit/debit cards for customers who want to use their cards to earn rewards, and use e-wallets for smaller, on-the-go payments.

How to transfer money using FPX?

A typical FPX transaction flow from a customer's perspective is as follows:

- Select FPX: The customer selects "FPX" as their preferred payment method on the merchant’s website.

- Choose bank: The customer is then presented with a list of participating banks and chooses their bank. Then, they are redirected to their bank’s secure internet banking login page.

- Login & authorize: The customer logs in to their online banking account and selects the account from which they want to pay. They then review and confirm the transaction details.

- Authentication: The bank uses security measures like Two-Factor Authentication (2FA) via a TAC (Transaction Authorization Code) or push notification to authenticate the transaction.

- Confirmation: Once authenticated, the bank processes the payment. The FPX network receives confirmation of the successful transaction and instantly notifies the merchant.

- Transaction complete: The customer is redirected back to the merchant's website, where a payment success page is displayed.

How to start accepting FPX payments?

Getting started with FPX is straightforward. Businesses can begin accepting FPX payments by following these steps:

- Choose a payment gateway: Select a payment gateway provider that offers FPX integration, such as Billplz.

- Sign up & register: Sign up for an account with the chosen provider and complete the necessary business verification.

- Integration: Integrate the payment gateway with your business platform. This can be done via plugins for platforms like WooCommerce and Shopify, or through API integration for custom-built websites.

- Testing: Conduct test transactions to ensure the payment flow is working correctly before going live.

- Go live & accept payments: Once testing is complete, you can start accepting FPX payments from your customers.

Also read: Shopify payment gateway in Malaysia with local payment methods

FPX payment guides for business owners

Follow these quick tips to ensure a smooth and secure FPX payment experience for your customers:

- Simplify checkout flow: Make the process fast and mobile-friendly. Display FPX clearly as a payment option to encourage use.

- Clear customer communication: Let users know FPX is a safe, real-time bank transfer—no cards required.

- Manage refunds & reconciliation: Use transaction IDs for easy tracking. Set expectations as FPX refunds may take several business days.

- Prioritize security: Ensure your site uses SSL, choose a compliant provider like Billplz, and enable fraud checks.

Billplz solutions for FPX payments

Billplz offers a seamless, cost-effective solution for businesses in Malaysia to accept FPX payments with ease.

With flat fees starting from RM 0.70 per transaction, Billplz makes it easy and affordable for businesses to manage payments. This is ideal for SMEs and growing brands looking for a secure and efficient solution.

Key features of Billplz's FPX payment solution include:

- FPX at a flat rate from as low as MYR 0.70.

- Fast settlement, with payouts reaching your account by the next business day.

- Real-time transaction confirmation, giving you instant updates on successful payments.

- A user-friendly dashboard for easy management, along with API integration for seamless automation.

- An optional split payment feature for more complex transactions.

- Enterprise-grade protection for every transaction with 2FA, and PCI DSS compliance.

A wide range of industries already trust Billplz for FPX payments, including e-commerce, education, NGOs, and event organisers.

Why choose Billplz for FPX payments?

Billplz is a preferred choice for FPX payments due to its commitment to security, transparency, and ease of use.

- Bank-level security ensures all transactions are safe.

- Transparent, low-cost pricing helps businesses manage expenses.

- 99.999% uptime reliability means payments are always available.

- Easy setup through a dashboard or API allows for quick integration.

- Scalable solutions cater to businesses of all sizes, from small businesses to large enterprises.

FAQ

Is FPX the same as online banking?

No. FPX is a payment gateway that facilitates a transaction through a customer's online banking account. It is the secure link between a merchant's website and the customer's bank.

Is FPX the same as DuitNow?

No, they are different services under the same operator, PayNet. FPX is a real-time bank transfer for online payments. Meanwhile, DuitNow is a broader service that includes online banking payments (DuitNow Online Banking/Wallets, which is replacing FPX) as well as peer-to-peer transfers using mobile numbers or NRICs (DuitNow QR and DuitNow Transfer).

Why is FPX trusted in Malaysia?

FPX is trusted because it is operated by PayNet (a subsidiary of Bank Negara Malaysia), and transactions are secured by the customer's own bank's high-standard security protocols and authentication methods.

What is the maximum limit for FPX?

The maximum limit varies by bank and account type. For personal accounts, the limit is typically up to RM30,000 per transaction, while for corporate accounts, it can be as high as RM1,000,000.

What is the minimum amount for FPX?

The minimum amount for an FPX transaction is typically RM1.00 for personal accounts.

How fast is FPX settlement?

The payment itself is real-time. For merchants, funds are typically settled and deposited into their bank account on the next business day, depending on their payment gateway provider.

Is FPX safe for online business transactions?

Yes. FPX uses bank-level security measures, including strong encryption and Two-Factor Authentication (2FA), to ensure all transactions are safe. It also does not store a customer's banking credentials.

What banks are supported under FPX?

Over 20 banks in Malaysia are supported by FPX, including Maybank, CIMB, Public Bank, RHB Bank, Hong Leong Bank, and many more.

How much does FPX cost per transaction?

The cost is typically a flat fee determined by the payment gateway or bank. Billplz offers flat fees starting from RM 0.70 per successful transaction.

Conclusion

FPX has cemented its role as a cornerstone of online payments in Malaysia. Its ability to provide fast, secure, and reliable transactions directly from bank accounts helps businesses build customer trust and streamline their payment processes.

By integrating FPX, businesses can tap into a broad base of customers and improve their operational efficiency.

Ready to simplify your business’s payment collections? Start accepting FPX payments today with Billplz – a simple, affordable, and trusted solution. New merchants receive MYR 25.00 in starter credit with code GROWTHPRO (valid until 31 December 2025).