POS system in Malaysia: How to choose the right one for your business

Nov 6, 2025

6 min

Key takeaways:

- POS systems help businesses manage sales, inventory, and customer data in one place.

- Choose a POS that supports Malaysian payment methods like FPX, DuitNow QR, e-wallets, and integrates with Billplz.

- Different types of POS systems suit different needs, such as retail, cafes, restaurants, and mobile setups.

- Important features include inventory tracking, payment options, CRM tools, cloud access, and offline mode.

- Start by identifying your business type, payment needs, and integration requirements before comparing options.

- Industry use cases show how POS systems improve efficiency across sectors like F&B, retail, and eCommerce.

- Billplz works with POS providers to offer faster payments, lower fees, and a unified view of your transactions.

Introduction

Managing payments, tracking inventory, and maintaining customer records used to be done separately.

Today, Point-of-Sale (POS) systems bring all of that into one place.

Whether you're running a kedai runcit, a retail outlet, or a fast-growing cafe, choosing the right POS system can simplify your operations and help your business scale.

Let’s understand what POS systems are, why they matter in the Malaysian context, how to evaluate one, and where Billplz fits into your payment ecosystem.

What is a POS system, and how does it work?

A POS system is the technology businesses use to complete sales transactions. It typically includes:

- Hardware: Terminal, receipt printer, barcode scanner, cash drawer.

- Software: Interface for processing sales, updating inventory, and managing reports.

When a customer makes a purchase, the POS system records the sale, processes the payment, deducts inventory, and updates reports.

Many modern POS systems in Malaysia now integrate directly with online payment gateways like Billplz, enabling unified payments via FPX, DuitNow QR, or e-wallets.

Why do businesses in Malaysia need a POS system?

As Malaysia continues to move toward digitalisation and cashless transactions, POS systems offer several essential benefits:

- Real-time tracking: Monitor sales and stock levels as they happen.

- Multiple payment support: Accept FPX, e-wallets, credit cards, and QR payments.

- Simplified reporting: Generate tax-ready sales and expense reports.

- Improved customer experience: Speed up checkout and offer more payment options.

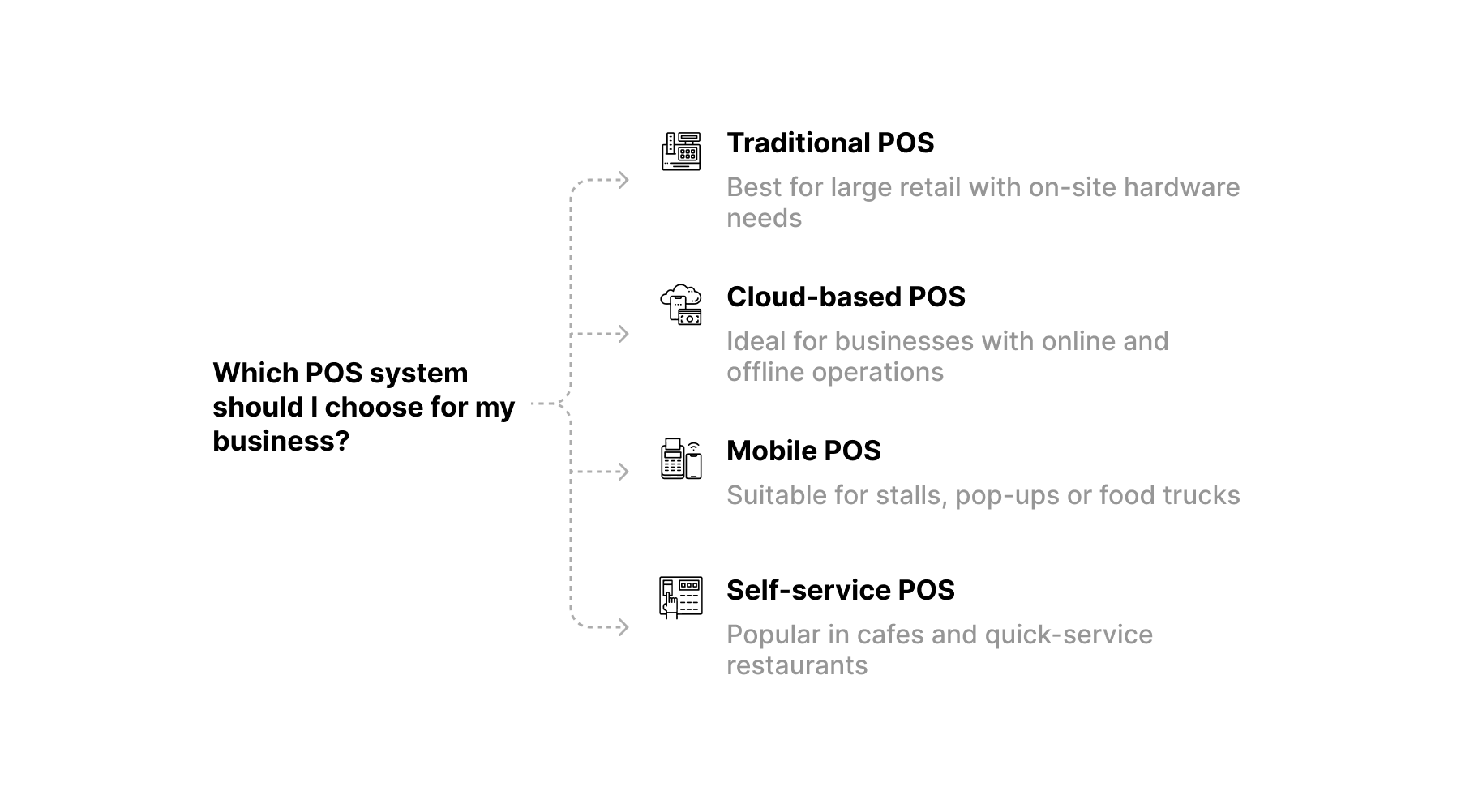

Types of POS systems

Choosing the right POS setup starts with understanding the different types:

- Traditional POS: Installed on-site using dedicated hardware. Common in large retail.

- Cloud-based POS: Accessible through browsers or apps; suitable for businesses with online and offline operations.

- Mobile POS (mPOS): Tablet or smartphone-based systems; great for stalls, pop-ups, or food trucks.

- Self-service POS: Kiosks and QR-based ordering; popular in cafes and quick-service restaurants.

What are the key features to look for in a POS system?

From payments to inventory tracking, here’s what to look for in a POS system that fits your business.

- Payment integration: Must support local methods like FPX, DuitNow QR, e-wallets, and Billplz.

- Inventory management: Auto-deducts stock, notifies of low inventory.

- Reporting & analytics: View sales trends, taxes, and performance in dashboards.

- Customer management (CRM): Loyalty programs and purchase history tracking.

- Multi-outlet support: Centralised view across multiple branches.

- Cloud storage: Access data anytime, anywhere.

- Offline mode: Keep operations running even during internet outages.

How to choose the right POS system for your business?

For Malaysian businesses, choosing a POS system means balancing features, cost, and local payment integration. Here’s a step-by-step approach to help you make a confident, practical decision:

- Step 1: Identify your business type: The right features depend on what you do. Restaurants may need table management and kitchen displays, while retail stores often prioritise barcode scanning and inventory control.

- Step 2: Decide on your payment ecosystem: Make sure the POS supports local payment methods like FPX, DuitNow QR, and major e-wallets. For seamless transactions, look for integration with trusted gateways.

- Step 3: Evaluate integration needs: Consider what tools you already use. A good POS should connect easily with platforms like Shopify, WooCommerce, and your accounting software to streamline operations.

- Step 4: Compare costs: Understand whether you're paying a one-time license or a monthly subscription. Don’t forget to factor in setup fees, future upgrades, and support services.

- Step 5: Consider scalability and after-sales support: As your business grows, your POS should grow with you. Choose a provider that offers reliable after-sales support and flexibility to add more features or outlets over time.

POS system examples and use cases by industry

POS system for restaurants

Restaurants often require a full-service POS that can handle both front-of-house and kitchen operations.

- Manage table reservations, kitchen orders, and bill splitting efficiently to reduce errors and wait times.

- Integrate with QR ordering systems and food delivery platforms like GrabFood or Foodpanda, allowing customers to place orders directly from their smartphones.

- Track menu items, customise modifiers (like “no onions”), and coordinate between the service floor and the kitchen seamlessly.

- Some systems even provide real-time kitchen performance analytics to help optimise prep time and reduce food waste.

POS system for retail

Retail POS systems are built to handle high transaction volume and detailed product management.

- Scan barcodes, manage discounts, and track inventory across multiple branches in real time.

- Support for SKU-level tracking and stock alerts helps avoid overstocking or stockouts.

- Enable loyalty programs and cashless checkout, encouraging repeat visits and faster transactions.

- Some systems allow product bundling, seasonal promotions, and customer purchase history tracking.

POS system for cafes

Cafes typically need fast, efficient systems that can handle high foot traffic during peak hours.

- Simplify counter service and queue management with touch-based ordering and quick payment flows.

- Accept multiple payments easily, including DuitNow QR, e-wallets, and cards to suit customer preferences.

- Popular features include digital menus, customer tipping options, and daily sales summaries.

- Integration with QR table ordering is increasingly common in modern cafe setups.

POS system for small businesses

Smaller operations benefit from easy-to-use, affordable systems that don’t require complex setup.

- Easy to set up and cost-effective, with intuitive interfaces suited for first-time users.\n- Cloud-based POS systems allow business owners to manage both physical and online sales from a single dashboard — useful for pasar malam stalls, home-based businesses, or weekend bazaars.

- Features like cash flow tracking and basic CRM tools help build better customer relationships without needing separate software.

Shopify POS

Shopify POS is ideal for businesses that already run a Shopify online store and want to expand into physical retail.

- Combines your online and in-person sales, creating a seamless experience for both the merchant and customer.

- Shared customer and inventory data across channels ensures consistent product availability and personalised service.

- You can run promotions that apply online and in-store, offer local pickup options, and use one dashboard for everything.

- Integrates well with Malaysian payment gateways like Billplz, making local payment collection hassle-free.

Also read: Shopify payment gateway in Malaysia with local payment methods

Billplz integration for POS payments

Billplz makes it easy for Malaysian businesses to accept in-person payments through FPX, DuitNow QR, and e-wallets, all within compatible POS systems.

- Instant settlement to your business account helps with cash flow.

- A unified dashboard tracks both online and offline payments in one place.

- Supports faster checkout, lower transaction costs, and local payment preferences.

This setup works well for SMEs, cafes, and retail chains looking to simplify operations without compromising on flexibility. Integration is possible through API or supported plugins. You just need to check with your POS provider for compatibility.

Read more about Billplz integrations here!

FAQ

What’s the difference between a POS system and a payment gateway?

A POS system manages sales, inventory, and reporting, while a payment gateway handles the actual transaction processing. They often integrate together.

How much does a POS system cost in Malaysia?

Prices vary from MYR 1,000 for basic systems to over MYR 10,000 for advanced setups. Monthly cloud-based subscriptions start around MYR 100.

Can a POS system work without the internet?

Yes. Many offer an offline mode where transactions are queued and sync later.

What is the best POS system for restaurants in Malaysia?

Look for systems with kitchen display support, order tracking, and QR integration. Options like StoreHub or Slurp! are popular.

Which POS system for retail supports e-wallet payments?

Many cloud-based POS providers support e-wallets through integrations with gateways like Billplz.

Is there an affordable POS system for small businesses in Malaysia?

Yes. mPOS and cloud-based setups offer affordable monthly plans with essential features.

What’s the difference between a POS system for a cafe and a restaurant POS?

Cafe systems focus on fast counter service, while restaurant systems handle table management, kitchen coordination, and multiple orders.

Can Shopify POS integrate with Malaysian payment gateways like Billplz?

Yes. Billplz offers plugins and API support to connect with Shopify and other platforms.

How do I integrate my POS system with eCommerce platforms like Shopify or WooCommerce?

Use POS systems that offer native plugins or API support for seamless integration with online stores.

Are POS systems in Malaysia secure, and how do they protect customer data?

Yes. Most modern POS systems in Malaysia comply with PCI DSS (Payment Card Industry Data Security Standards) to ensure all card transactions are encrypted and tokenised. Reputable providers also use SSL encryption, role-based access controls, and regular software updates to protect both business and customer data.

For added security, choose POS systems that integrate with trusted local gateways like Billplz, which follow strict compliance and secure payment protocols under Bank Negara Malaysia’s guidelines.

Conclusion

Choosing the right POS system comes down to your business needs, budget, and local payment preferences. A system that works seamlessly with Malaysian payment gateways like Billplz ensures better integration, smoother checkout, and future-ready operations.

Explore Billplz integrations to power your POS system with seamless, local payment solutions.

Start with Billplz to give your business a trusted, scalable payment backbone designed for the future. New merchants receive MYR 25.00 in starter credit with code GROWTHPRO (valid until 31 December 2025).