Toyyibpay vs Billplz: Which payment gateway should you choose?

Oct 15, 2025

5 min

Key takeaways:

- Toyyibpay is ideal for NGOs, micro-businesses, and simple payment needs, offering a Shariah-compliant setup and flat FPX rates.

- Billplz supports a wider range of payment options, including FPX, DuitNow, QR, e-wallets, and BNPL — built for SMEs and scaling enterprises.

- Pricing: Toyyibpay offers low-cost entry, while Billplz provides transparent, competitive rates with feature-rich plans.

- Integrations: Billplz connects directly with Shopify, WooCommerce, and custom APIs; Toyyibpay offers limited e-commerce plugin support.

- Settlement speed: Billplz offers faster payouts (next-day for FPX, real-time for DuitNow) compared to Toyyibpay's 1–4 business day timeline.

- Scalability: Billplz provides a professional-grade infrastructure with tools like split payments, dashboards, and catalog tools — ideal for high-volume or multi-channel businesses.

Introduction

Payment gateways are essential for Malaysian businesses, especially for SMEs, NGOs, and online sellers. Two popular options in the local market are Toyyibpay and Billplz — both offering strong capabilities for accepting online payments.

This article provides a detailed comparison of both platforms, including features, pricing, and use cases, to help you decide the right fit.

Overview of both platforms

Both Toyyibpay and Billplz serve as essential online payment solutions in Malaysia, but they cater to different types of users and business growth stages.

What is Toyyibpay?

Toyyibpay is a Shariah-compliant online payment gateway popular among NGOs, micro-businesses, and crowdfunding initiatives. It’s widely used for its simplicity and minimal setup requirements.

The platform allows businesses and nonprofits to generate payment links and collect payments via FPX or cards with low fees.

Its straightforward interface and ease of use make it appealing to first-time sellers or organisations looking to accept basic online payments quickly.

What is Billplz?

Billplz is a leading Malaysian payment gateway trusted by SMEs and enterprises for its reliability, scalability, and developer-friendly features. Designed to support growing businesses, it offers a powerful suite of tools including a real-time dashboard, advanced APIs, and seamless plugin integrations.

With support for a wide range of local payment methods, including FPX, DuitNow, e-wallets, and Buy Now Pay Later (BNPL), Billplz helps businesses streamline transactions and enhance customer convenience.

Its transparent, cost-effective pricing and scalable infrastructure make it easy for businesses to grow efficiently.

Key comparison table: Billplz vs. Toyyibpay

| Feature | Toyyibpay | Billplz |

| Target Users | NGOs, micro-businesses, and small sellers | SMEs, e-commerce, and enterprises |

| Payment Methods | FPX, and Credit/Debit Cards | FPX, DuitNow, QR, E-wallets (GrabPay, TNG, ShopeePay), BNPL (Atome, Grab PayLater), and cards |

| Pricing | Flat RM1.00 per transaction for B2C and RM2.00 for B2B (Standard Plan) | Transparent flat pricing (e.g., RM0.70 for FPX) |

| Settlement | 1–4 business days | Next business day (FPX), real-time for DuitNow transfer |

| Features | Bill link generation and recurring payments | Full dashboard, split payments, API, and plugins |

| Scalability | Best for small-scale transactions | High-volume, multi-channel support |

| Support | Basic customer service | Dedicated local team, enterprise-grade reliability |

| Integrations | Limited e-commerce plugins | Shopify, WooCommerce, custom APIs, and enterprise tools |

Fees and pricing

Toyyibpay is known for very low startup fees (often free setup) and a flat FPX B2C transaction fee of typically RM1.00 (Standard plan). It is ideal for micro-sellers and NGOs due to the low entry barrier.

Billplz offers flat, transparent pricing. The FPX B2C transaction fee is RM1.10 on the free Basic plan, but drops to RM0.70 on the annual Standard plan. This structure balances cost with a more powerful, feature-rich platform.

For very small businesses with minimal volume, Toyyibpay may be the cheapest start. For scaling businesses, Billplz's professional plans offer a lower cost per transaction, balanced with superior reliability and features.

Read more on Billplz pricing here!

Payment methods

Toyyibpay primarily supports FPX and local credit/debit card payments, making it a suitable choice for basic online transactions and straightforward payment collection.

Billplz offers a significantly wider range of local payment options, including FPX, DuitNow Transfer (Real-time payout), DuitNow QR, major E-wallets (GrabPay, Touch 'n Go, ShopeePay, Boost), and BNPL providers (Atome, Grab PayLater).

This wider coverage makes Billplz more future-proof, ensuring you can accept payments via your customers' preferred method, which is crucial for modern e-commerce growth.

Also read: Shopify payment gateway in Malaysia with local payment methods

Features & integrations

Toyyibpay:

- Simple bill link generation and QR code creation.

- Recurring billing (popular for subscriptions/donations).

- Easy-to-use for small, single-channel projects.

Billplz:

- Rich feature set like split payments, payout management, and team permissions (Single Sign-On or SSO).

- Developer-first with a robust API and webhooks, allowing custom, complex integrations.

- Direct integrations with major e-commerce platforms like Shopify and WooCommerce, plus a library of over 30 prebuilt plugins for quick setup.

- Real-time dashboard for detailed analytics and efficient reconciliation.

Read more about Billplz integrations here!

Reliability & scalability

Toyyibpay works well for micro/SME sellers but may face limitations when handling the high volume, complex payment routing, or multi-channel operations required by a scaling business.

Billplz is built for enterprise reliability, offering a 99.999% historical API uptime and faster settlements. Its infrastructure supports high-volume processing and provides advanced features like dedicated support and H2H (Host-to-Host) integration for corporations.

Businesses aiming to scale their e-commerce operations or expand across channels will find Billplz more future-proof and sustainable.

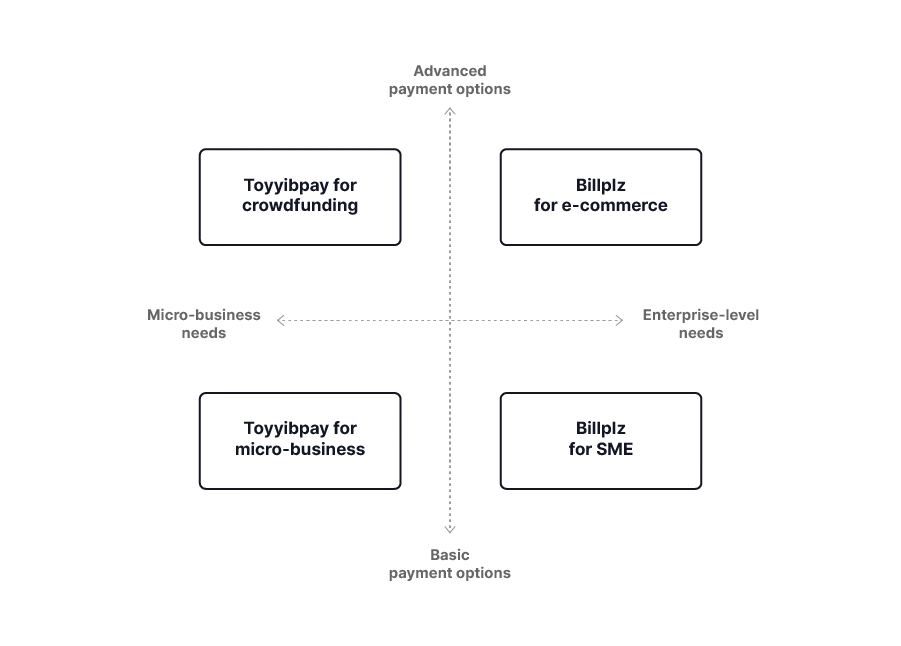

Which should you choose: Billplz or Toyyibpay?

Choose Billplz if:

- You are scaling beyond small payments into SME or enterprise levels.

- You want the widest variety of local payment options: FPX, DuitNow, e-wallets, and BNPL.

- You run an e-commerce store like Shopify and need robust, official plugins.

- You require faster settlements and enterprise-level reliability.

- You need advanced operational features like split payments or multi-user access for your team.

Choose Toyyibpay if:

- You are a micro-business, NGO, or crowdfunding project and need a quick, low-cost setup with simple payment links.

- Your customer payments are primarily limited to FPX or card, and transaction volume is low.

Think of Toyyibpay as your initial launchpad for simple transactions. If you plan to scale, Billplz provides the reliable, feature-rich infrastructure that moves you beyond the basics to handle multi-channel sales, complex payment flows, and high volume efficiently.

How does Billplz support your growth?

While Toyyibpay is excellent for getting started, offering immediate simplicity and low entry costs, Billplz is engineered to grow with your business, providing the robust infrastructure needed to handle future complexity and high transaction volumes.

Billplz offers a professional, scalable infrastructure:

- Fast payouts: FPX funds are paid out on the next business day, with DuitNow Transfers settled in real-time, dramatically improving cash flow efficiency.

- Flat, transparent pricing: Predictable costs that simplify budgeting and ensure that transaction costs scale predictably as your volume increases.

- Real-time dashboard & analytics: Provides a complete, consolidated view of all transactions, enabling faster reconciliation, data-driven decisions, and real-time monitoring of business health.

- Robust API & 30+ plugins: Offers a powerful REST API for custom integrations and numerous prebuilt plugins for major platforms like Shopify and WooCommerce.

- Split payments: Automatically distribute funds between multiple accounts, perfect for marketplace models or managing multiple revenue streams.

- Commerce tools (Catalog): Includes Catalog Payment Form (prebuilt payment links for services/fundraising) and Catalog Store (a simple online storefront), extending your sales capabilities without requiring a developer.

- Enterprise-ready security: Maintains Bank-level security and PCI DSS compliance, ensuring a protected environment as your transaction volume and data complexity increase.

FAQ

Is Toyyibpay Shariah-compliant?

Yes. Toyyibpay was designed with Shariah-compliant principles and is widely used by NGOs and Islamic-based institutions.

Does Billplz support FPX payments?

Yes. FPX (online bank transfer) is Billplz's core service. FPX B2C fees range from RM0.70 to RM1.10 per transaction, and payouts are guaranteed on the next business day.

Also read: FPX payment for business: How it works, guides & our solutions

Which payment gateway is better for small businesses in Malaysia?

Toyyibpay is great for starting out. But if your business is growing, Billplz offers more features, integrations, and reliability.

Can Toyyibpay and Billplz integrate with Shopify or WooCommerce?

Billplz does. It has official integrations with Shopify and WooCommerce. Toyyibpay has limited support for e-commerce platforms.

Which has faster settlements: Toyyibpay or Billplz?

Billplz generally offers faster settlements, including next-day FPX payout. Toyyibpay payouts typically take 1–4 business days.

Conclusion

In the Malaysian market, both Toyyibpay and Billplz offer reliable payment collection services.

For entry-level users, small NGOs, and simple payment link needs, Toyyibpay provides immediate ease and affordability.

But for any business with growth ambitions, from SMEs to larger enterprises, Billplz delivers greater long-term value. It not only matches Toyyibpay on core FPX efficiency but significantly extends capabilities with multi-user access, dedicated e-commerce plugins, and a wide array of payment methods, ensuring a seamless experience as you expand.

The choice is between simplicity today and scalability tomorrow.

Start with Billplz to give your business a trusted, scalable payment backbone designed for the future. New merchants receive MYR 25.00 in starter credit with code GROWTHPRO (valid until 31 December 2025).

For more information about Billplz, read: