Merchant Discount Rate: What is it & its impact on transactions

Dec 2, 2025

5 min

Key takeaways:

- MDR stands for Merchant Discount Rate, a fee charged to businesses for accepting electronic payments like cards, e-wallets, and online transfers.

- MDR is made up of several components, like interchange fees, card network charges, and payment gateway markups.

- In Malaysia, MDR varies by payment method, with credit cards typically carrying the highest rates, while FPX and DuitNow QR offer more affordable options.

- High MDR can affect your profit margins, especially for SMEs, and may influence which payment methods you promote or accept.

- Businesses can reduce MDR costs by encouraging local payment methods, negotiating with providers, and optimising their checkout experience.

- Billplz supports local payment rails and transparent pricing, helping Malaysian merchants manage MDR more efficiently and sustainably.

Introduction

For any business that accepts payments electronically, whether by card, e-wallet, or online transfer, the Merchant Discount Rate (MDR) is a cost that quietly affects every transaction. It might be just a few percent, but over time, it can significantly shape your margins.

With Malaysia’s growing adoption of FPX, DuitNow QR, and e-wallets, understanding MDR has become more important.

This guide breaks down MDR, what influences it, and how businesses can reduce costs, especially with local solutions like Billplz.

What is a Merchant Discount Rate (MDR) and how does it work?

The Merchant Discount Rate (MDR) is the fee a business pays each time it accepts an electronic payment. The fee is usually a small percentage of the transaction value and is deducted automatically before the funds reach your bank account.

A simple example:

If your MDR is 2% and a customer pays RM100, you’ll receive RM98 in your bank account, and RM2 goes to the payment provider and other intermediaries.

MDR is a standard part of electronic payments in Malaysia, and understanding how it works helps businesses manage costs and protect margins.

What are the components of the Merchant Discount Rate?

MDR is made up of several underlying fees, each serving a different part of the payment process:

- Interchange fee: Paid to the cardholder’s bank. This covers fraud risk, authorisation, and handling the transaction. Credit cards usually have higher interchange fees than debit cards.

- Card scheme or network fee: Charged by global networks such as Visa and Mastercard. This fee supports the network infrastructure that routes and verifies card payments.

- Acquirer or payment gateway markup: Added by the provider that processes the transaction for the merchant. This is where pricing can vary widely depending on the gateway, business type, volume, and negotiated terms.

MDR vs interchange fee

Interchange fees and Merchant Discount Rates (MDR) are closely related, but they’re not the same.

The interchange fee is a base cost set by the card networks (like Visa or Mastercard) and paid to the cardholder’s bank every time a transaction is made. It covers the cost of processing, fraud protection, and risk management. While important, this fee is only one part of the overall payment cost.

The MDR is the total fee a merchant pays per transaction. It includes:

- The interchange fee,

- The card network’s fee, and

- The payment gateway or acquirer’s markup.

As a business owner, you don’t typically see the breakdown of these individual fees. What you do see is the final MDR on your transaction reports.

How does MDR affect your transactions and margins?

MDR is deducted before you receive the funds, which means it directly reduces your net revenue. For small businesses or high-volume merchants, even a 1–2% fee can impact profit margins over time.

In Malaysia, credit card payments often carry a higher MDR (up to 3%), while e-wallets range from 1%–2%. Local methods like FPX and DuitNow QR typically offer lower MDR, making them a more cost-efficient option for small businesses.

Beyond fees, MDR can also shape business decisions; from how you price products to which payment methods you promote. Many merchants favour lower-MDR options to protect their margins, especially for high-volume or local transactions.

What factors influence the MDR rate?

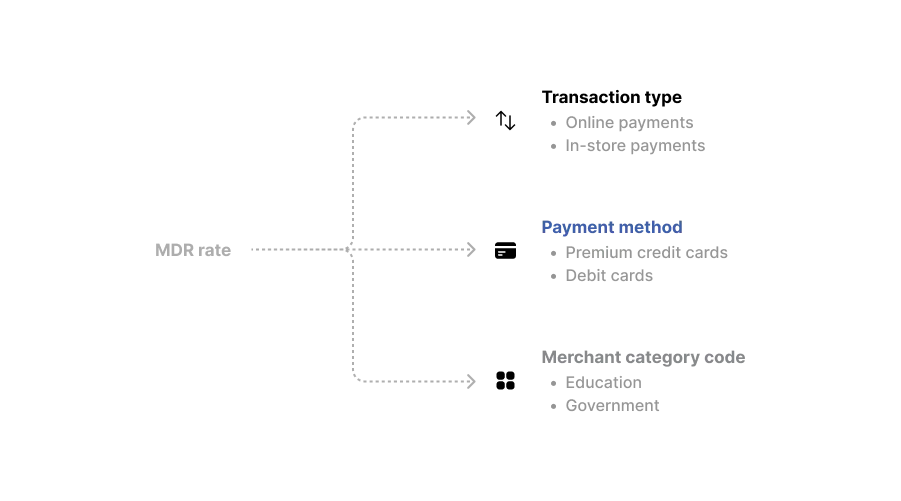

MDR isn’t a fixed fee. It varies depending on your business type, payment method, and how the transaction is processed. Key factors include:

- Transaction type: Online or card‑not‑present payments usually carry a higher MDR due to fraud risk. In‑store payments often cost less.

- Payment method: Premium credit cards tend to cost more than debit cards or QR-based payments.

- Merchant Category Code (MCC): This business classification affects network fees. Some categories, like education or government, enjoy a lower MDR.

- Business size and transaction volume: Higher volume merchants may qualify for better rates through negotiation.

- Currency and country: Cross-border and foreign currency payments typically involve higher fees.

- Payment provider markup: Each gateway adds its own charges, impacting your final MDR.

What is a typical MDR in Malaysia?

Merchant Discount Rates in Malaysia vary depending on the payment method and provider. Here’s what you can expect:

- Credit cards: Around 1.5% to 3%, depending on card type and provider

- Debit cards: Typically below 1%

- E-wallets: Usually fall between 1% to 2%

- FPX and DuitNow QR: Range from 0% to 3%, often lower for SMEs

- Buy Now Pay Later (BNPL): Can go from 1.5% to over 3%, depending on the provider’s model.

Some QR payment providers also waive MDR for micro-merchants or during promotional periods, especially under initiatives to support digital adoption. Always confirm the exact rate with your payment provider, as costs can vary based on your industry, transaction volume, and merchant classification.

How can businesses reduce their MDR charges and improve payment cost efficiency?

While MDR is unavoidable, smart decisions can help you manage the cost. Start by prioritising lower-cost methods like FPX and DuitNow QR for local payments. Encourage debit card or e-wallet usage over credit cards, which often carry higher fees.

A streamlined checkout also reduces failed payments and disputes, helping you avoid unnecessary costs. If you process high volumes or recurring transactions, talk to your provider about better rates.

With local rails, transparent pricing, and real-time fee visibility, Billplz gives Malaysian businesses the tools to reduce MDR and improve their payment cost structure.

Role of payment gateway in MDR: How does Billplz help?

Your choice of payment gateway directly affects how much you pay in MDR. From the payment methods available to how fees are structured and reported, it all adds up, especially for growing businesses.

Billplz is designed with Malaysian merchants in mind, offering:

- Transparent, MYR-based pricing with no hidden charges, so you always know what you're paying for.

- Support for lower-cost, local payment methods like FPX, DuitNow QR, and e-wallets, helping reduce your MDR from the start.

- Real-time reporting and reconciliation tools that let you track every fee, transaction, and settlement clearly.

- Flexible plans, including optional PayPal integration for businesses that also serve international customers.

Whether you're running an online store, managing recurring payments, or collecting donations, Billplz gives you the control and clarity to keep your costs efficient and predictable.

Also read: Jom Duitnow with Billplz: Solutions for online businesses.

FAQ

How does MDR affect my business profitability?

It reduces your net earnings from each sale. Even a small percentage can add up, especially for businesses with tight margins or high-volume transactions.

Are there MDR waivers for small businesses in Malaysia?

Yes. Some QR-based payments (like DuitNow QR) come with reduced or waived MDR, especially for micro and small merchants, depending on the acquiring bank or payment provider.

Does accepting e-wallets or QR reduce my MDR?

Often, yes. E-wallet and QR-based payments typically have lower MDR compared to credit cards, making them a cost-effective option for local transactions.

What is the average merchant discount rate for businesses?

Most MDRs fall between 1% to 3%, depending on the payment method, business category, and provider. QR and debit card rates are generally on the lower end.

How do interchange fees relate to MDR?

Interchange fees are one component of MDR, paid to the cardholder’s bank. Merchants don’t see this breakdown; they only pay the final MDR charged by their gateway.

Can merchants negotiate their MDR?

Yes. Businesses with high transaction volume or low-risk profiles can often negotiate lower MDR rates with their payment gateway or acquiring bank.

Why is MDR higher for online transactions?

Online (card-not-present) payments carry higher fraud risk and processing complexity, which results in higher MDR.

How is MDR different for credit and debit cards?

Credit cards generally have higher MDR due to risk and reward-based fees. Debit card transactions are processed at a lower cost and usually carry a lower MDR.

Conclusion

MDR is part of doing business in a digital economy, but that doesn’t mean it should go unchecked. For Malaysian merchants, understanding how MDR works, what influences it, and how to control it can lead to better margins and healthier cash flow.

By choosing a gateway like Billplz that prioritises local payment rails and transparent pricing, businesses can gain better control over payment costs without compromising on customer experience.

Review your current MDR rates, compare providers, and explore how Billplz can help bring more clarity, control, and cost-efficiency to your payment process.