Stripe vs PayPal: Which payment gateway should you choose?

Dec 2, 2025

7 min

Key takeaways:

- Stripe and PayPal are strong global platforms, but each serves different business needs.

- Stripe offers flexible, developer-driven payment infrastructure ideal for SaaS and scaling eCommerce.

- PayPal provides quick setup, broad consumer trust, and simple invoicing for freelancers and small businesses.

- Neither platform fully supports Malaysian payment methods such as DuitNow QR or local e-wallets.

- Billplz fills this local gap with MYR‑native support for FPX, DuitNow, e-wallets, BNPL, and fast bank settlements.

- With optional integrations, Billplz lets businesses manage both local and international payments in one dashboard.

Introduction

Stripe and PayPal are two of the most recognised names in global payments. Whether you’re running an eCommerce store, a SaaS platform, or freelancing across borders, chances are you’ve come across both.

While Stripe is known for its developer-first, scalable infrastructure, PayPal dominates with its ease of use and brand familiarity. In this guide, we’ll compare the two across setup, features, fees, and suitability for Malaysian businesses.

Overview of both platforms

What is Stripe?

Stripe is a full-stack payment processor offering APIs and infrastructure for businesses to accept online and offline payments. It’s especially popular among startups and tech-forward companies thanks to its deep customisation and automation capabilities.

While Stripe is officially available in Malaysia, it lacks support for local payment methods like DuitNow, which can be limiting for merchants serving local customers.

What is PayPal?

PayPal is a digital wallet and payment processor that enables users to send, receive, and store money online. For businesses, it offers an easy-to-set-up gateway that integrates with major platforms like Shopify and WooCommerce.

Its plug-and-play setup, along with high consumer trust, makes PayPal a convenient choice for small businesses and freelancers. However, its fees are notably higher for international transactions.

Stripe vs PayPal: Comparison of key features

Here’s a side-by-side look at how Stripe and PayPal compare across key business and payment features.

| Feature | Stripe | PayPal |

| Core Focus | Developer-first payment infrastructure for custom integration | Consumer-facing digital wallet and checkout solution |

| Ideal For | SaaS platforms, global marketplaces, and scalable eCommerce | Freelancers, small businesses, and service-based eCommerce |

| Payment Methods | Credit/debit cards, Apple Pay, Alipay; limited support for local methods | Cards, PayPal wallet; limited support for local bank or QR methods |

| Malaysian Support | Available since 2019; does not support FPX or DuitNow natively | Available and supports MYR; local withdrawals enabled |

| Setup Complexity | Requires developer resources for setup and integration | Simple setup with ready-to-use plugins and minimal technical effort |

| Fees | 3.0% + FX markup per transaction (may vary by use case) | 3.9%–4.4% + FX markup and fixed fee per transaction |

| Payout Time | Typically 5–7 business days to Malaysian bank accounts | Usually 3–5 business days for local withdrawals |

| Platform Integration | Highly flexible with API; integrates with Shopify, WooCommerce, and more | Built-in integrations with major platforms and marketplaces |

Also read: Wise vs PayPal: Which payment gateway should you choose?

Ease of use and setup

Stripe is built for developers, requiring technical resources for setup and customisation. This enables highly tailored payment flows but adds complexity.

PayPal, by contrast, is designed for ease. You can start accepting payments within minutes, making it ideal for solo entrepreneurs or smaller teams.

Features and flexibility

Stripe shines in flexibility, supporting over 135 currencies, recurring billing, and real-time reporting. Its APIs are robust and suitable for scaling businesses.

PayPal is simpler, offering invoicing, instant payments, and access to business tools like debit cards and working capital loans. It’s effective but limited in comparison.

Stripe vs PayPal: Fees and currency exchange rates

Stripe fees

Stripe charges around 3.0% per transaction, plus a small fixed fee (e.g. MYR 1.00). Cross-border transactions involve currency conversion fees, though they’re not always clearly broken out. There are no monthly or setup fees, but custom integration may require developer costs.

PayPal fees

PayPal typically charges 3.9–4.4% + MYR 2.00 per transaction, along with a currency conversion markup (around 3% to 4%). You may also incur withdrawal and cross-border fees. These charges can accumulate quickly, especially for freelancers or small businesses dealing with overseas clients.

Payment methods and local compatibility

Stripe is excellent for card-based transactions and supports Apple/Google Pay. However, it lacks native support for DuitNow or local e-wallets in Malaysia.

PayPal supports its own wallet and card payments, and allows local bank withdrawals. But like Stripe, it doesn’t offer built-in support for Malaysian BNPL or QR payments.

For businesses in Malaysia, this gap can limit how easily your customers pay, especially if they prefer local methods like FPX or DuitNow QR. Local-focused providers like Billplz help close that gap by supporting the payment methods Malaysians already use without needing to patch together extra tools.

Stripe vs PayPal for international payments

Stripe is generally stronger for international payments, offering lower cross‑border fees, broader multi‑currency support, and more flexibility for businesses that want to build a customised global checkout. It’s designed for scale, especially if you’re running subscriptions, SaaS, or high‑volume international eCommerce.

PayPal, on the other hand, remains a practical choice if you want something fast to set up and familiar to customers worldwide. Its global wallet and trusted brand make it easy for buyers to complete payments, even if the overall costs are higher.

Stripe vs PayPal: Integrations & development tools

Stripe is widely praised for its developer-first approach. With support for webhooks, custom workflows, and advanced billing logic, it’s ideal for SaaS and marketplaces.

PayPal keeps it simple. With plugins for WooCommerce, Shopify, and other platforms, it works well for non-technical users or teams without in-house developers.

Also read: Shopify vs WooCommerce (WordPress): An updated comprehensive comparison

Stripe vs PayPal: Security and compliance

Both platforms are PCI DSS Level 1 certified, meaning they meet the highest standards for payment security. This reduces compliance burdens for businesses and protects cardholder data.

Use case comparison

Stripe and PayPal each shine in different scenarios, so the right choice depends on how your business operates and who you're serving.

Stripe vs PayPal for freelancers and remote workers

PayPal is often the go-to for freelancers. It’s easy to set up and widely recognised by global clients. But its high fees and currency conversion costs can quickly eat into your earnings.

Stripe is less common among individual freelancers but works well for agencies or small businesses with the resources to set up custom workflows. Its flexibility makes it ideal if you’re billing clients at scale or handling recurring payments.

eCommerce businesses

If you're launching an online store, PayPal makes it easy to get started. It integrates with major platforms like Shopify and WooCommerce, and customers trust the brand at checkout.

Stripe, meanwhile, is built for scaling. It offers customisable, branded payment flows and is ideal if you’re expanding internationally or want more control over your checkout experience.

SaaS and subscription platforms

Stripe leads the way here. Its built-in tools for recurring billing, metered pricing, and automation make it a favourite for SaaS businesses. You can customise almost everything if you’ve got the dev resources.

PayPal does offer recurring payments, but it’s not as flexible or automated. It’s best for simpler subscription models.

Stripe vs PayPal for Malaysian businesses

While both platforms support global payments, they don’t natively offer Malaysian payment methods. That gap matters, especially if your customers expect to pay using familiar, local channels.

Local-first providers like Billplz help bridge this, offering Malaysian payment rails and optional PayPal integration. That way, you can serve both local and international customers with one connected setup.

Which payment gateway is best in Malaysia?

Stripe and PayPal are both powerful, but neither is a complete fit for the Malaysian market.

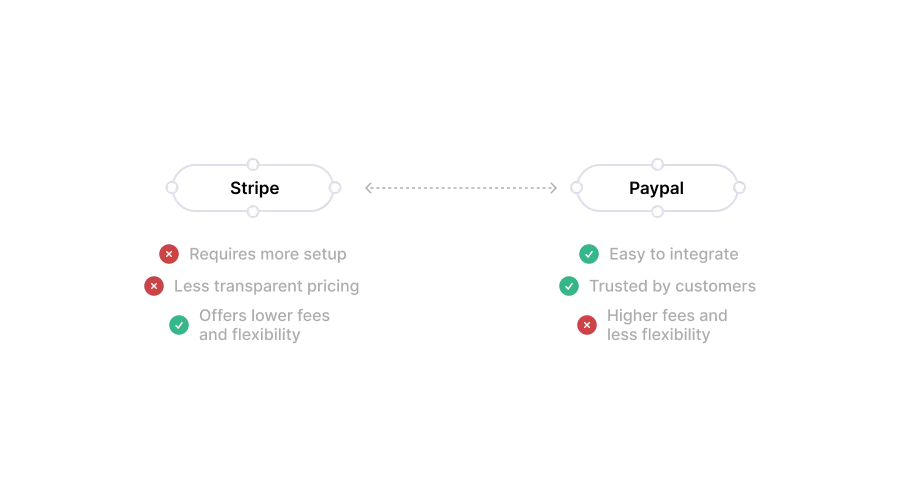

- Fees: Stripe may offer slightly lower rates overall, but its FX markups and less transparent structure make it harder to predict. PayPal, while pricier, is easier to understand, especially for low-volume users or one-off transactions.

- Ease of Integration: PayPal is plug-and-play and great for getting started quickly. Stripe takes more setup but offers unmatched flexibility once integrated.

- Use Case Fit: Stripe shines for SaaS, scaling startups, and custom payment flows. PayPal is ideal for freelancers, small eCommerce, and global client billing.

- Customer Preference: Many Malaysian customers and international clients recognise and trust PayPal, especially at checkout.

Where does Billplz fit in for Malaysian businesses?

Billplz bridges what global platforms miss: seamless local payments tailored for Malaysian businesses.

Built specifically for Malaysian businesses, it supports FPX, DuitNow QR, major e-wallets like TNG, Boost, and GrabPay, as well as BNPL options. This means your customers can pay the way they prefer, securely and instantly.

With MYR-native pricing, no currency conversion losses, and fast settlements to local bank accounts, you stay in control of your revenue and cash flow.

Billplz also integrates with PayPal, giving businesses the ability to manage both local and international payments within a single, consolidated dashboard.

While Stripe supports global scale and PayPal enables international transactions, Billplz complements them by offering the local infrastructure Malaysian businesses need to operate efficiently.

Also read:

- FPX payment for business: How it works, guides & our solutions

- Jom Duitnow with Billplz: Solutions for Online Businesses

- BNPL Malaysia & Billplz: Our integrations, comparisons & offerings

FAQ

Is Stripe better than PayPal?

It depends. Stripe is better for scalable, tech-forward businesses. PayPal is easier to use and trusted by consumers.

Can I use Stripe in Malaysia?

Yes, Stripe has been available in Malaysia since 2019.

Is Stripe owned by PayPal?

No. Stripe and PayPal are entirely separate companies. They are competitors in the global payments space and operate independently.

Do I need both Stripe and PayPal?

Many businesses use both. Stripe provides flexibility and customisation for backend payment flows, while PayPal offers ease of use and trust with consumers, particularly in markets where PayPal is widely adopted.

Does Stripe hold your money like PayPal?

Stripe typically settles payouts within 5–7 business days and is upfront about its processing timelines. PayPal may hold funds temporarily for risk reviews, especially for new or high-risk accounts.

Which platform is cheaper for online transactions in 2025?

Stripe tends to be cheaper, especially at scale. But exact fees vary by transaction type.

Does Stripe support local Malaysian payment methods?

Stripe supports FPX, Malaysia’s bank transfer system, allowing customers to pay directly from their local bank accounts.

In addition, it offers international payment methods such as credit and debit cards (Visa, Mastercard) and digital wallets like Google Pay and Apple Pay, all in Malaysian Ringgit (MYR).

Does PayPal support Malaysian Ringgit (MYR) transactions?

Yes, PayPal supports MYR for both domestic and international transactions. You can hold a MYR balance and send or receive payments in Malaysian Ringgit within supported contexts.

How do Stripe and PayPal compare in terms of settlement speed?

PayPal typically settles to Malaysian bank accounts within 3–5 business days. Stripe takes slightly longer, usually 5–7 business days. Timing may vary depending on the account and transaction history.

Conclusion

Stripe and PayPal each offer unique strengths for online payments. Stripe is built for flexibility and scale, making it ideal for businesses with technical teams and custom workflows. PayPal, on the other hand, is easy to set up, widely recognised, and trusted by customers around the world.

But for Malaysian businesses, global tools alone aren’t always enough. Local payment preferences play a major role in conversion and customer satisfaction.

Billplz bridges this gap by offering:

- A local-first gateway with support for FPX, DuitNow, BNPL, and major e-wallets

- Transparent, MYR-based pricing with no FX markups

- Integrations for a unified local and global payment experience

With Billplz, you can accept payments the way your customers prefer and manage them all from one secure, scalable platform.

Explore how Billplz fits into your payment flow and supports your business growth.

To learn more about Billplz, read:

- SenangPay vs Billplz: Which payment gateway should you choose?

- iPay88 vs Billplz: Which payment gateway should you choose?

- Billplz vs Stripe: Which payment gateway should you choose?

- Billplz vs Curlec: Which payment gateway should you choose?

- Toyyibpay vs Billplz: Which payment gateway should you choose?